2022 was supposed to be a stellar year for airlines due to pent-up travel demand following the reopening of the economy. However, staff shortages, higher labor costs, and increased fuel costs made the journey difficult for airlines. Nonetheless, North American airlines are set to return to profitability in 2022, with the International Air Transport Association (IATA) estimating higher profits from the region in 2023.

IATA expects European and Middle East carriers to swing to profits in 2023 from this year’s losses. Meanwhile, it projects Asia Pacific, Latin America, and African carriers to post lower losses in 2023. Overall, the trade body expects the global airline industry to deliver a net profit of $4.7 billion in 2023 compared to an expected loss of $6.9 billion in 2022. This improvement is anticipated despite growing economic uncertainties. Prior to the pandemic, global airlines had generated net profits of $26.4 billion in 2019.

North America Set to Bounce Back

As per the IATA, North America is the only region expected to return to profitability in 2022, with estimated profits of $9.9 billion. It expects the region’s profits to increase to $11.4 billion in 2023. IATA highlighted that carriers in the region gained from fewer travel restrictions than many other countries, which boosted the business in the large U.S. domestic market and international travel across the Atlantic.

Also, carriers in the U.S. passed on the impact of higher costs to customers by significantly increasing airfares. Based on the Consumer Price Index (CPI) data provided by the Labor Department, U.S. airline fares increased 36% year-over-year in November, though they cooled down compared to the 43% gain seen in October and September. November 2022 airfares were also higher than the airfares in the corresponding month in 2019.

With airfares expected to remain high in 2023 and demand estimated to be resilient despite macro headwinds, let’s take a look at two attractive U.S. airline stocks.

Delta Air Lines (DAL)

Delta Air Lines (NYSE:DAL) recently impressed investors as it raised its Q4 2022 and full-year outlook and issued solid guidance for 2023. Delta now expects 2022 adjusted EPS in the range of $3.07 to $3.12 and 2023 EPS to be between $5 and $6. Furthermore, it projects its 2024 EPS to be more than $7.

Delta expects 2023 revenue growth in the range of 15% to 20%, fueled by the full restoration of its network and continued improvements in premium and loyalty revenue. It aims to generate free cash flows of more than $2 billion in 2023, which should help it further reduce its debt.

Is Delta a Buy or Sell?

Recently, Goldman Sachs analyst Catherine O’Brien resumed coverage on Delta Air Lines stock with a Buy rating and a price target of $40. O’Brien highlighted that DAL stock fared better than other U.S. airline stocks in her coverage, backed by improved international and corporate travel and a “relatively stronger balance sheet in light of rising rates.”

The analyst is bullish on Delta due to “1) exposure to end markets that are still recovering; 2) continued growth of its less cyclical revenue streams; and 3) relatively strong balance sheet.”

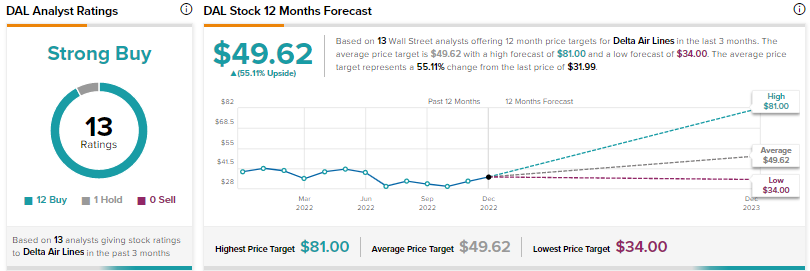

Wall Street’s Strong Buy consensus rating for Delta Air Lines stock is based on 12 Buys and one Hold. The average DAL stock price target of $49.62 implies 55.1% upside potential. As per TipRanks’ Smart Score System, DAL scores a nine out of 10, which implies that the stock could outperform the market averages over the long term.

United Airlines (UAL)

United Airlines (NASDAQ:UAL) delivered upbeat third-quarter results and assured investors about continued momentum in Q4 2022 and 2023. It expects Q4 adjusted operating margin to exceed 2019 levels, driven by strong revenue and improving cost trends.

The carrier recently announced the purchase of 100 Boeing (BA) 787 Dreamliners and 100 737 MAXs to replace its older, less-efficient aircraft. The deal with Boeing also includes options to buy up to 100 additional 787 aircraft.

What is the Prediction for United Airlines Stock?

Aside from Delta, O’Brien is also bullish about United Airlines, Alaska Air Group (ALK), and Allegiant Travel Company (ALGT). The analyst stated that in the current environment, he prefers carriers with “idiosyncratic earnings drivers, relatively more recovery tailwinds remaining, or characteristics that reduce downside risk.”

Wall Street is cautiously optimistic about United Airlines stock, with a Moderate Buy consensus rating based on seven Buys, one Hold, and one Sell. The average UAL stock price target of $57.11 suggests 53.2% upside potential.

On TipRanks, UAL stock earns a Smart Score of eight of 10, which implies that the stock has the potential to outperform the broader market over the long term.

Conclusion

U.S. airlines are expected to continue to recover in 2023 despite growing fears of an economic downturn and other challenges. Higher airfares are anticipated to help airlines cover increased input costs.

Special end-of-year offer: Access TipRanks Premium tools for an all-time low price! Click to learn more.