Almost three months have passed since COVID-19 began its spread beyond China’s borders, and the market remains in free fall. Capping off another volatile week, stocks fell on Friday April 3 in response to disappointing U.S. economic data, offsetting gains posted in the previous session.

Based on a new report from the Labor Department, the U.S. economy saw 701,000 jobs erased in March, much more than economists originally expected as the figure doesn’t even include the 10 million unemployment filings that occurred after March 14.

In addition, New York Governor Andrew Cuomo announced on Friday that the state had experienced the biggest jump in COVID-19-related deaths the day before, sending the market plummeting even further.

For those investors feeling hopeless right now, there’s a bright spot on the horizon. Several companies have stepped up to the plate, developing innovative solutions to fight off the deadly virus. According to some Wall Street pros, these new technologies represent a possible inflection point in the war against COVID-19, and could even help drive the stock market’s recovery.

Taking all of this into consideration, we used TipRanks’ database to get more information on three stocks at the frontline of the COVID-19 battle. The investing platform revealed that all of these Buy-rated tickers have been flagged by some analysts for their technology’s huge potential. Let’s get started.

Abbott Laboratories (ABT)

In the fight against COVID-19, Abbott’s tests to identify the virus have helped healthcare providers make significant headway.

Along with its molecular test that is already being used in labs throughout the U.S., the company revealed on April 3 that the FDA granted emergency use authorization (EUA) for a rapid coronavirus testing system. As the product can detect positive results in five minutes and negative results in 13 minutes, much faster than any other available COVID-19 tests, Wall Street focus has locked in on ABT.

Weighing in for Barclays, analyst Kristen Stewart believes the test will be performed on the ID NOW platform, an isothermal nucleic acid amplification technology, and thus offers advantages that go beyond its speed.

“The system is easy to use with minimal training. The tests are CLIA waived, which is an advantage and allows for the placement in physician offices and urgent care offices. We estimate there are at least 15,000 systems in the United States, placed throughout physician offices, urgent care offices, and other healthcare facilities,” Stewart explained.

As for the total opportunity, Stewart doesn’t dispute that Abbott’s manufacturing capacity, which she thinks would be the rate limiting factor as there is significant demand for the test, remains unclear. “The pricing would likely be under the non-CDC pricing ~$51 level, perhaps in the $35-$45 range. We hope Abbott would supply these details when it announces approval,” the analyst noted.

That being said, 4 million of its molecular tests can be conducted each month on its m2000 systems, with ABT charging about $30 per test. As a result, Stewart kept an Overweight call and $98 price target on the stock. Should this target be met, a twelve-month gain of 23% could be in the cards. (To watch Stewart’s track record, click here)

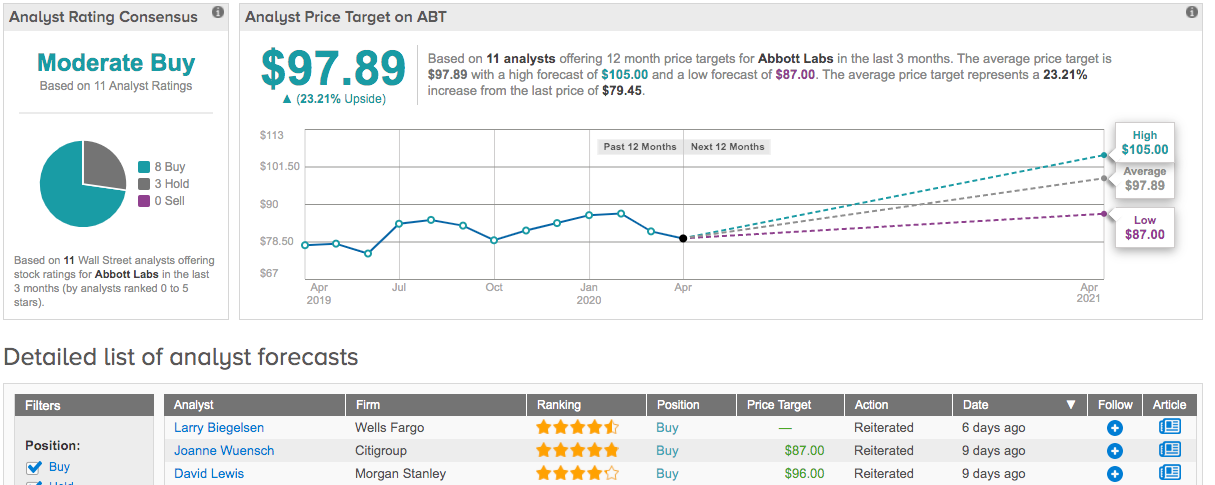

Turning now to other Wall Street analysts, the bulls have it. With 8 Buy ratings and 3 Holds assigned in the last three months, the consensus rating comes in as a Moderate Buy. The $97.89 average price target implies only slightly less upside potential than Stewart’s forecast. (See Abbott stock analysis on TipRanks)

Johnson & Johnson (JNJ)

Next up is a consumer goods and healthcare heavyweight, Johnson & Johnson, which is developing a vaccine against COVID-19. After the company identified a lead candidate, one analyst thinks JNJ is one of the names capable of fueling the stock market’s turnaround.

With a lead experimental vaccine candidate selected, Kristen Stewart, who also covers ABT, points out that at the latest, JNJ can kick off Phase 1 human clinical studies by September 2020. According to management, the first doses of the vaccine could be available under Emergency Use Authorization (EUA) in early 2021.

Adding to the good news, JNJ has significantly expanded its partnership with the Biomedical Advanced Research and Development Authority (BARDA), with both entities pledging more than $1 billion to co-fund the vaccine’s development and clinical testing. If that wasn’t enough, Stewart notes “BARDA and JNJ have provided additional funding to allow expansion of ongoing work to identify anti-viral treatments against COVID-19.”

However, while JNJ has ramped up the scaling of manufacturing capacity and has a target of supplying more than 1 billion vaccine doses, there is a risk that the candidate won’t eventually receive approval.

Having said that, Stewart argues the real goal is to develop an affordable vaccine “on a not-for-profit basis for emergency pandemic use.” She added, “Thus we would anticipate the cost it would charge for the vaccine would recoup the cost of development, cost of scaling up the manufacturing, and cost of production. Thus, we would not look at the vaccine as being a windfall or major positive from a financial perspective. We believe J&J is doing the right thing and adhering to the company’s long-running Credo.”

Despite the fact that its medical device business could take a hit as elective procedures are delayed, its COVID-19 vaccine candidate, balanced portfolio, strong balance sheet and dividend, yielding 2.8% and paying out $3.80 per share annually, reaffirm Stewart’s confidence. Bearing this in mind, she maintained a Buy rating and $173 price target. This implies shares could surge 29% in the next year.

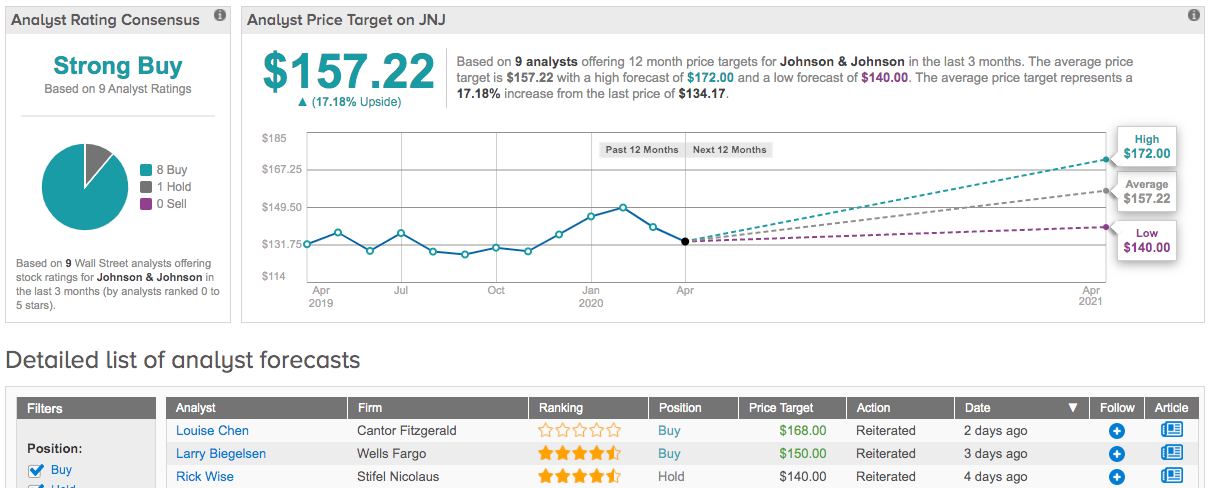

What does the rest of the Street have to say? Out of 9 recent reviews, 8 were bullish, making the consensus rating a Strong Buy. In addition, the $157.22 average price target brings the upside potential to 17%. (See Johnson & Johnson stock analysis on TipRanks)

Gilead Sciences (GILD)

Biotech Gilead Sciences has grabbed headlines left and right thanks to its experimental COVID-19 treatment, remdesivir. With the company now stating it will donate 1.5 million doses of the drug, which could treat 140,000 patients, it’s no wonder some analysts are standing firmly behind GILD.

Shares are up 20% year-to-date, but Jeffries’ Michael Yee believes its growth story is still heating up. Looking at the big picture, he argues, “GILD remains a defensive positioning stock particularly in this macro environment. We appreciate short-term trading has been mostly dictated around market volatility risk-on/off and expectations on remdesivir for COVID-19 data starting in April.”

That being said, there’s more to this biotech’s “improving story”. The company has placed a significant focus on expansion, with its recent M&A activity including a $5 billion deal with immuno-oncology company Forty Seven. Additionally, its second quarter Phase 3 filgotinib UC data readout could send shares on an upward trajectory as well as improve sentiment surrounding the drug’s differentiation from AbbVie.

Yee already thinks that the pbo-adjusted remission rates imply that filgotinib is “competitive with other UC drugs.” Expounding on this, he stated, “While we expect investors to make cross-trial comparisons, we caution comparing directly to other UC datasets is imprecise due to differing baseline characteristics such as proportion of biologic naive/experienced and slightly different endpoints of the Mayo score. However — recent commentary from GILD suggests positive confidence around results and good activity in both biologic naive and experienced.”

With an August PDUFA date for filgotinib in RA, Yee does, however, acknowledge that a class label Black Box could be given as a result of uncertainty related to degree of bleeding difference between various JAK drugs. It’s also still unclear if filgotinib will be approved at the 200mg dose.

Commenting on the second issue, Yee said, “In any case, it’s reasonable to approve 200mg particularly if the MANTA interim look is OK but FDA is a conservative bunch. Also, even if not, we point out ABBV was only approved at the low dose in RA as well so it would not be a totally critical issue.” To this end, Yee reiterated a Buy recommendation and $89 price target, indicating 14% upside potential. (To watch Yee’s track record, click here)

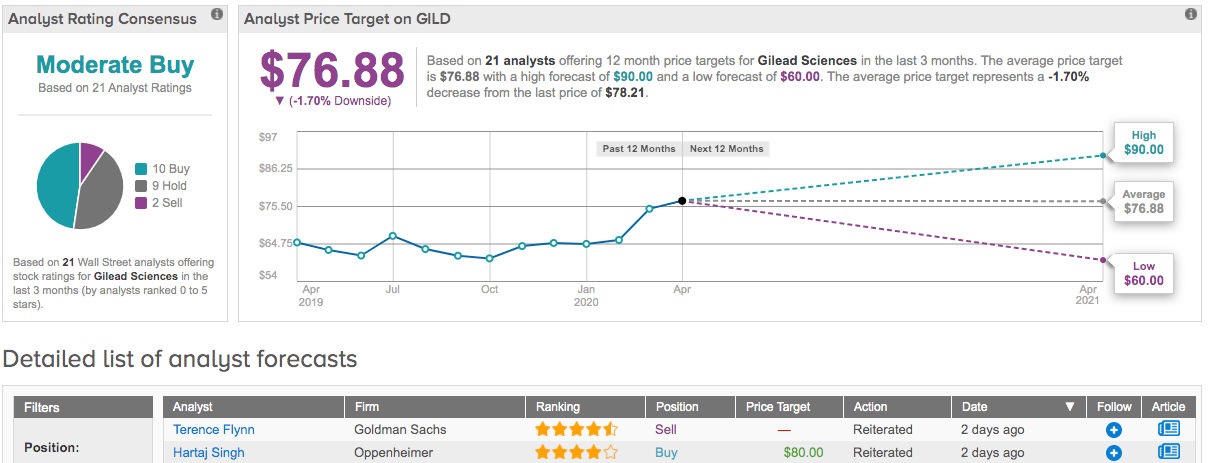

Looking at the consensus breakdown, 10 Buys, 9 Holds and 2 Sells add up to a Moderate Buy consensus rating. At $76.88, the average price target puts the downside potential at 2%. (See Gilead stock analysis on TipRanks)

To find good ideas for coronavirus stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.