Have investors forgotten about Micron (MU)? Amid all the attention surrounding coronavirus, it’s hard to argue if it feels that way. But with the chip giant expected to release earnings after market close tomorrow, the spotlight will be back on Micron.

Ahead of the print, Susquehanna’s Mehdi Hosseini has been trimming estimates. Although, as the analyst notes, in the current climate it is hard to gauge earnings on a quarterly basis, the reduction is for earnings in FY20/21. The new targets are for EPS of $1.89/$4.39, down from the previous estimates of $2.26/$6.61.

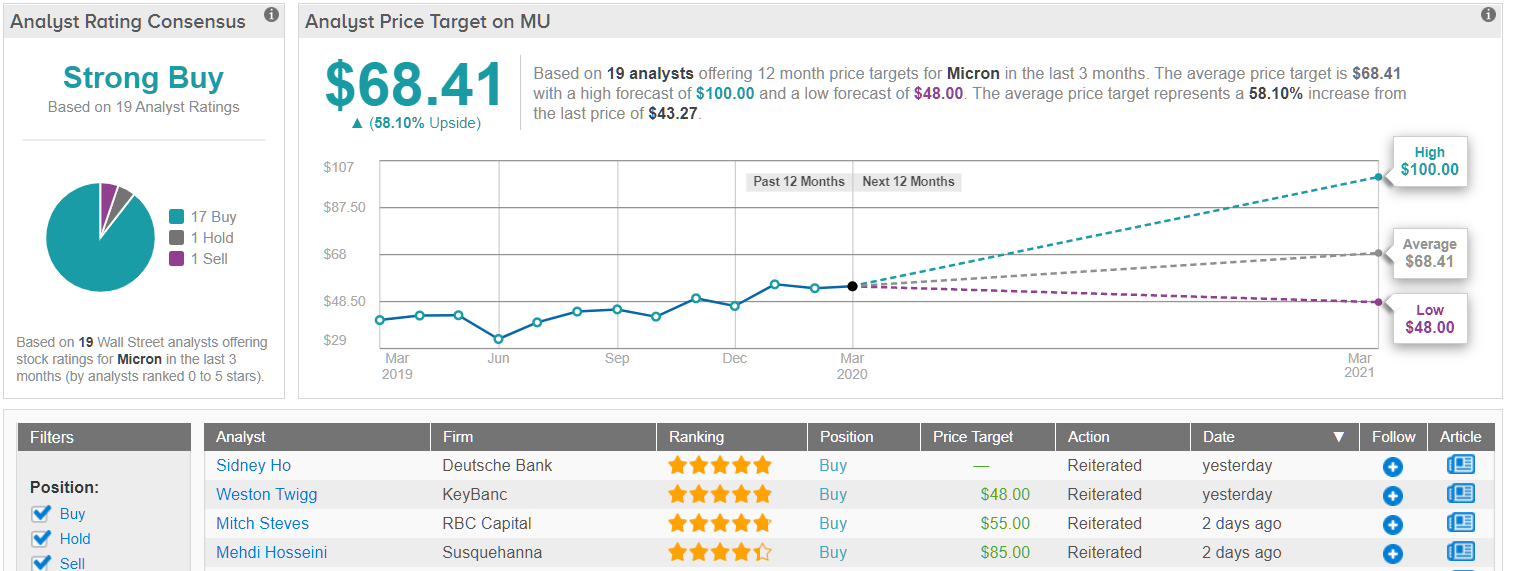

Nevertheless, Hosseini reiterates a Buy rating on Micron shares, along with a price target of $85. The potential upside from current levels is an impressive 96%. (To watch Hosseini’s track record, click here)

The 4-star analyst said, “We expect MU’s February-quarter results/May-quarter guide to meet our estimates (in-line with consensus) as supply chain disruption in China is expected to be offset by stronger ASPs. Nonetheless, we are using this opportunity to reduce August/November-quarter bit shipment/ASP assumptions to reflect weaker demand despite full recovery in the supply.”

Hosseini also argues the most important catalyst for the stock won’t be the February-quarter report, but rather “determining the extent of demand destruction” which won’t become clear until May. The analyst expects 2H CY20, in particular, to reflect the current problems and the revised estimates lay the ground for “a weaker demand environment.”

Although COVID-19’s impact in China will play its part in the current quarterly statement, the good news for Micron, weirdly enough, is its strong exposure to the giant from the far east. Huawei and Kingston make up roughly between 20-25% of its business, and together with “lean inventories among all memory manufacturers” and the fact Europe and North America have yet to probably feel the full force of coronavirus’ impact, the heavy exposure could come in handy as the year progresses. China is slowly recovering from the viral outbreak and getting back to normal. “We believe China exposure is now a good thing that could effectively provide MU with a cushion against weakening demand in the EU and North America regions,” Hosseini said.

The rest of the Street appears to echo Hosseini sentiment. As it has racked up 17 Buys and only 1 Hold, the consensus is unanimous: MU is a Strong Buy. Adding to the good news, the average price target of $69.34 could provide investors with gains in the shape of 58%, over the coming months. (See Micron stock analysis on TipRanks)