Earnings season is here. And that means the biggest players in the market are getting ready to release very important earnings reports. One of those big players is Facebook (FB). The social media giant is set to report first-quarter numbers after the bell on Wednesday, April 29.

Ahead of one of Wall Street’s most anticipated quarterly statements, RBC’s Mark Mahaney has been crunching the numbers. The 5-star analyst argues that given the pullback in ad spend “street estimates for Q1 are likely optimistic.” Mahaney calls for revenue, operating Income, and GAAP EPS of $16.78 billion, $5.55 billion, and $1.62, respectively. The figures are noticeably lower than the Street’s estimates of $17.42 billion, $6.05 billion, and $1.75.

Key areas of focus for Mahaney are advertising revenue growth and user growth and engagement. This is hardly surprising, as the two areas have been impacted the most by COVID-19, though each in the opposite direction.

In fact, in countries which have enacted the most aggressive measures to reduce the spread of COVID-19, the differences have been particularly acute, with Facebook reporting a weakening of ad business, in tandem with total messaging up by 50% in many of those hit the hardest. Since the crisis hit Italy, for example, there has been 70% increase in time spent on Facebook apps.

However, ad spend rather than engagement, accounts for the majority of Facebook’s revenue (indeed, across practically all social media platforms). As the economy contracts and budgets are slashed, Facebook will feel the bite, too. Mahaney believes “FB was clipping along at mid-20s % growth until mid-March when growth rapidly decelerated.”

But the worst is yet to come. “We assume that Q2 will be the worst impacted quarter with ex-FX Ad revenue down 21% Y/Y before making a partial recovery in Q3 (-11%) and Q4 (+5%),” Mahaney said.

Nevertheless, despite lowering estimates, there are enough growth drivers for Mahaney to remain positive on Facebook long-term. These include a “very large, growing user base” – 2.9 billion active users and still adding users by double digits year-over-year – a host of names under its umbrella such as WhatApp being ripe for further monetization, and high margins driving EBITDA in the mid 50%s.

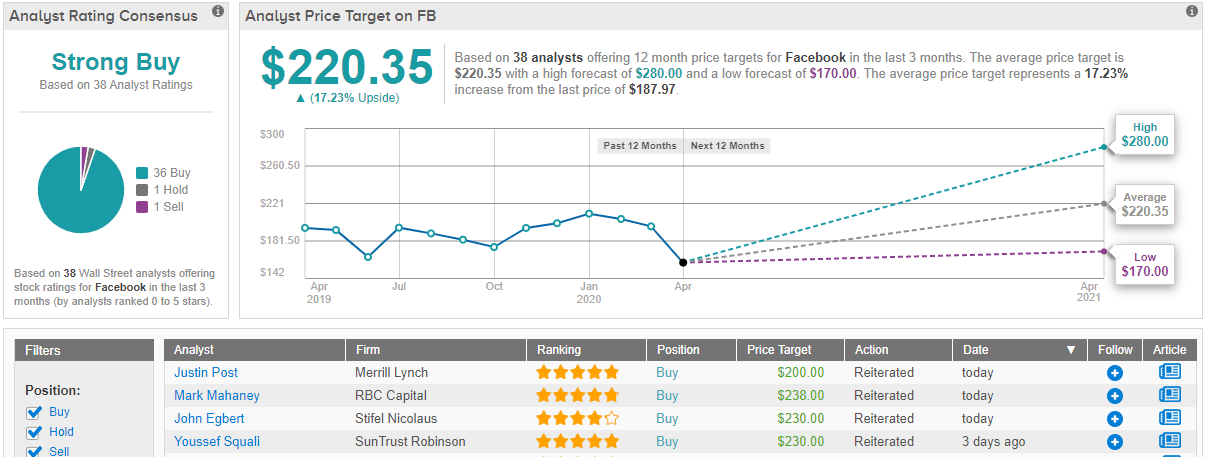

Accordingly, Mahaney reiterates an Outperform on Facebook shares, along with a $238 price target, which implies nearly 27% upside from current levels. (To watch Mahaney’s track record, click here)

The rest of the Street has no doubts concerning Fakebook’s long term prospects, either. A Strong Buy consensus rating is backed by 36 Buys, and a Hold and Sell each. The average price target stands at $222.41, and implies possible upside of 17% over the next year. (See Facebook stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.