An Indian eCommerce juggernaut just raised millions at a $36 billion valuation. Interestingly, the capital raise brings some of the largest stocks in the U.S., Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Walmart (NYSE:WMT), Amazon(NASDAQ:AMZN), and Microsoft (NASDAQ:MSFT), into the same frame in the eCommerce space in India. The country is one of the largest consumer markets globally, and these U.S. giants are making waves in this space.

Unlikely Names Come Together

Flipkart raised nearly $350 million from Google under a nearly $1 billion funding round. Walmart, which owns Flipkart, led the round. While Microsoft is also an investor in Flipkart, Amazon is one of its largest competitors in the country.

While Others Wade In

Notably, Flipkart controls nearly 48% of the eCommerce pie in India. The lucrative market has also attracted some of the largest names on Wall Street. Masayoshi Son’s SoftBank (OTC:SFTBF) is backing Meesho, another rising eCommerce name in India. Meanwhile, Reliance Retail, which was last valued at around $100 billion, has bagged investment from KKR (NYSE:KKR), according to TechCrunch.

Not the Only Turf in Town

Interestingly, Google and Amazon are also going toe-to-toe in the digital payments space in India. Google, reaching nearly half a billion people in India, is banking on its ubiquitous presence to grab a larger slice of the digital payments market with Google Pay. Meanwhile, Amazon, leveraging its extensive supply chain reach, has been pushing for wider adoption of its Amazon Pay service in the country.

What’s at Stake

While these developments highlight how top U.S. names are vying for growth in major markets, the fortunes of Flipkart could impact Walmart’s financials in a major way. Walmart is pondering over a potential listing of Flipkart, and a bumper IPO could further strengthen the retail giant’s balance sheet.

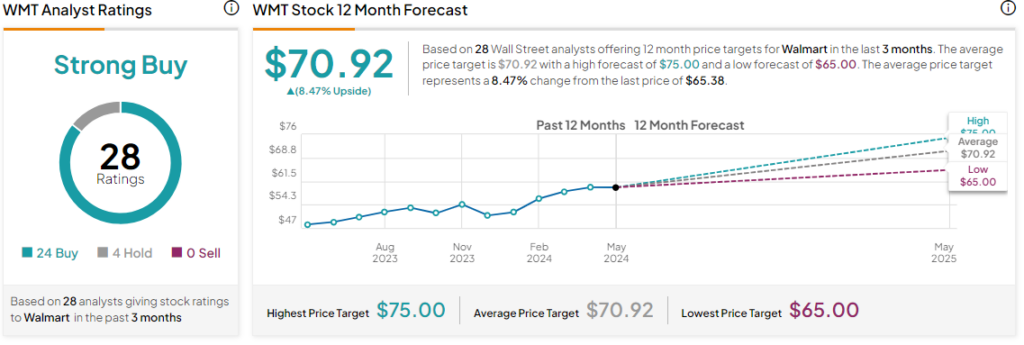

What Is WMT Stock Price Target?

Walmart’s share price has rallied by nearly 36% over the past year, and the Street is optimistic about the stock with a Strong Buy consensus rating. The average WMT price target of $70.92 points to a modest 8.5% potential upside in the retail giant.

Read full Disclosure