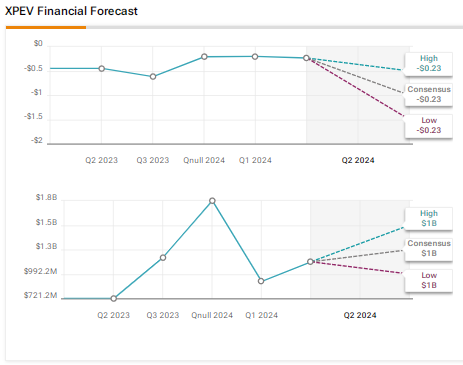

Chinese electric vehicle (EV) maker XPeng ($XPEV) is scheduled to announce its third-quarter results on November 19. Analysts expect the company to report a loss per American Depositary Share (ADS) of $0.29 in Q3 2024 compared to $0.62 in the prior-year quarter. They estimate revenue to rise around 19% year-over-year to $1.39 billion.

XPeng reported a 16% increase in its Q3 vehicle deliveries, reaching 46,533 units. The quarter gained from the successful launch of new models, mainly the XPeng MONA M03, which exceeded 10,000 deliveries in September, the model’s first month of deliveries.

Sentiment Ahead of XPeng’s Q3 Results

XPeng recently impressed investors when it displayed its autonomous driving capabilities at its AI Day in Guangzhou and unveiled the P7+ smart electric sedan that will compete with Tesla’s ($TSLA) full self-driving (FSD) technology.

Earlier this month, Morgan Stanley analyst Tim Hsiao raised his price target on XPeng stock to $17 from $11.70 and reiterated a Buy rating. He is confident about the upside in XPeng’s ADS and Hong Kong-listed shares based on the company’s ability to capture the next AI megatrend.

Hsiao is upbeat about the company’s innovation and continued expansion of its capacity in both vehicle and non-vehicle product lines, which will likely enhance its economic moat in the competitive EV market. Moreover, he thinks that XPeng is poised to witness a strong model cycle, starting with the successful M03 launch. He expects an “operational resurgence” from the second half of 2024, backed by new models, accelerating international expansion, and incremental contribution from the partnership with Volkswagen ($DE:VOW) to bolster EV development.

Options Traders Anticipate a Major Move

TipRanks’ Options tool offers a quick way to gauge what options traders anticipate from the stock following its earnings report. The expected earnings move is calculated using the at-the-money straddle of the options set to expire closest to the announcement. While this may sound complex, the tool handles the calculations for you.

Currently, it indicates that options traders are predicting about an 11.2% swing in either direction in XPEV stock.

Is XPeng Stock a Buy?

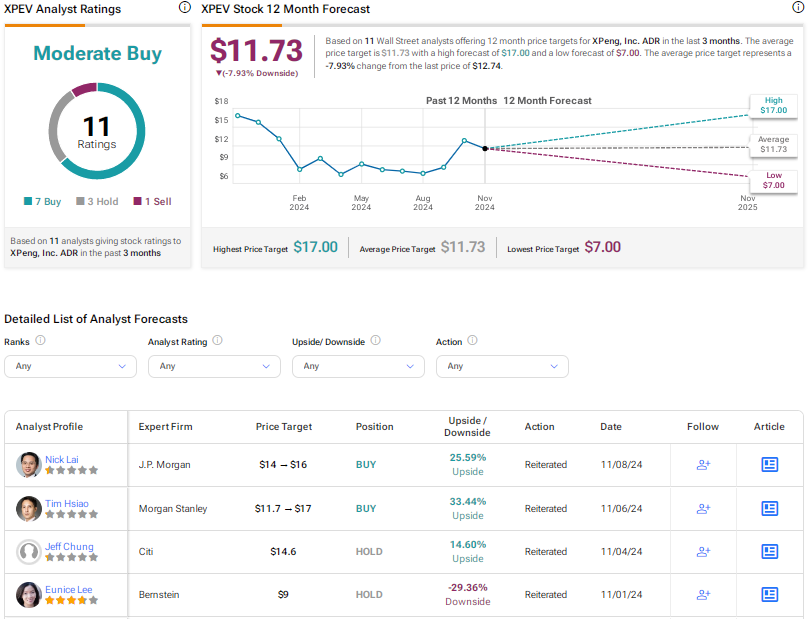

Ahead of the Q3 results, Wall Street has a Moderate Buy consensus rating on XPeng stock based on seven Buys, three Holds, and one Sell recommendation. The cautious optimism reflects confidence about the company’s long-term prospects despite near-term concerns over the uncertain macro environment in China, higher tariffs, and intense competition in the EV market.

The average XPeng stock price target of $11.73 indicates an 8% possible downside from current levels.