Zoom’s (ZM) penetration of the mainstream came seemingly out of nowhere. It is hard to remember that outside of business circles, not many knew about the app two months ago. With the share price appreciating by 70% since the turn of the year, there’s no doubt it has been one of this strange period’s success stories. But has the stock climbed too fast, too soon? It appears one 5-star analyst thinks so.

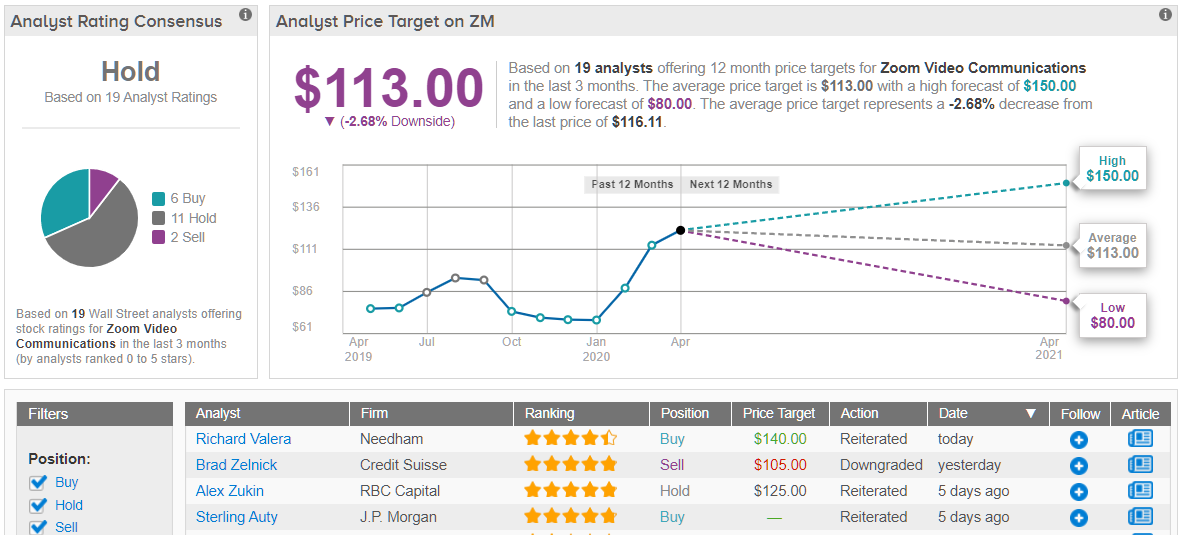

Brad Zelnick of Credit Suisse downgraded Zoom from Neutral to Underperform, although the price target gets a boost – from $95 to $105. The new figure indicates Zelnick foresees a 11% drop for the video-conferencing platform’s share price over the next year. (To watch Zelnick’s track record, click here)

So, why the negative sentiment towards a product that has become significantly more popular over the last couple of months? Simply put, Zelnick believes Zoom is overvalued, as the current lofty share price means the company is “priced for perfection.” Furthermore, as an equity analyst, Zelnick believes it’s his responsibility to “distinguish great companies from great stocks.”

The analyst explained, “We have great appreciation for Zoom’s technology, products, and leadership and see the current crisis accelerating the adoption of video communication, but at 40x CY20 consensus revenue, the current share price embeds significantly greater conversion of free users than our upside model scenario.”

Although Zelnick commends Zoom’s role as a “superhero of the current health crisis,” the recent surge in customer base will be hard to monetize, considering the majority of new additions are free users and schools. Secondly, Zelnick argues, although Zoom currently has the best product for these times, competition in the category is fierce and soon “every UCaaS vendor will eventually offer its own video solution.” Competitor RingCentral recently launched its own video conferencing product, and, in the long term, Microsoft Teams will likely emerge as its greatest rival.

Last but not least, Zoom’s increasing popularity has also brought to light security issues. The recent hacking of user accounts and worries of data security breaches have put the app under intense scrutiny. “While many of these issues, especially those stemming from user error, will likely be resolved in short order, we anticipate others may linger for some time,” Zelnick added.

Overall, the Street remains slightly more positive on Zoom’s prospects. TipRanks analysis of 19 analyst ratings shows a consensus Hold rating, with 6 analysts recommending Buy, 11 suggesting Hold and 2 advising Sell. The average price target among these analysts stands at $113, which implies a modest 3% downside from current levels. (See Zoom stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.