Popular video-conferencing company Zoom Video Communications (ZM) is working on a plan to improve the encryption of video calls for paying clients and institutions such as schools, but not for users of its free consumer accounts, a company official told Reuters.

To execute the plan, Zoom has hired security experts after a series of security failures led some institutions to ban its use. The encryption plan has been discussed on a call with civil liberties groups and child-sex abuse fighters, according to Zoom security consultant Alex Stamos.

The Silicon Valley-based company has been coping with increased traffic, as millions of users flocked to use its free and paying technology to host business and social meetings during the coronavirus-related lockdown affecting many countries around the world.

Zoom has gone from an average of 10 million daily users to 300 million this year. However, the user boom has also led to mis-steps and unwanted participants in meetings raising doubt on the security of the platform.

“At the same time that Zoom is trying to improve security, they are also significantly upgrading their trust and safety,” said Stamos. “The current plan is paid customers plus enterprise accounts where the company knows who they are.”

Shares rose another 9.7% to $179.48 on Friday, after more than doubling so far this year.

Commenting on the security concerns, five-star analyst Ryan Koontz at Rosenblatt Securities said on Friday that he believes that Zoom has “responded decisively to address both training and technical shortcomings which likely only slightly impacted the company’s near-term business adoption and brand”.

Still, Koontz maintained a Hold rating on the stock, saying that although he sees “tremendous opportunity” in a high-growth market, he also sees long valuation risks including sales execution, competition, and a long list of enterprise and government security concerns.

“We believe businesses around the world have rapidly adopted video collaboration as a critical business continuity tool which we expect should drive strong upside to conservative FY21 consensus numbers,” Koontz wrote in a note to investors. “Increasing competitive threats in enterprise represent our largest concern in FY22 and beyond if the company cannot improve its enterprise-class features and channel.”

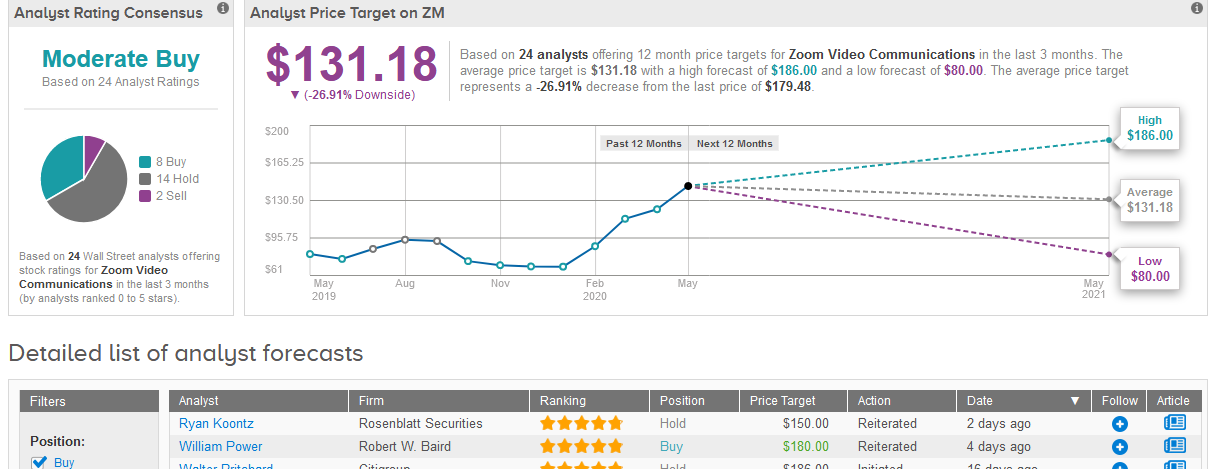

The analyst raised Zoom’s price target to $150 from $95 (16% downside to current levels), saying that given the stock’s “meteoric” rise (+ 138% vs S&P -7% YTD), he believes buy-side expectations are sky-high and near-term stock upside is minimal.

The rest of the Street sees stronger downside risk in the stock. The $131.18 average analyst price target implies shares may decline 27% from current levels. (See Zoom stock analysis on TipRanks). Turning now to analysts’ ratings, TipRanks data shows 14 assign a Hold, 8 say Buy, and 2 have a Sell adding up to a Moderate buy consensus.

Related News:

Facebook-Backed Reliance Launches Powerful Online Grocery Service In India

Facebook Rolls Out Online Shopping Platform For Businesses

Microsoft Launches Cloud-Based Platform For Healthcare Organizations