While video-conferencing company Zoom Video Communications (ZM) is still on the right side of the digital transformation secular trend, it’s not the only name in town. It may have been the go-to offering when pandemic lockdowns swept the world. However, many firms have taken notice, and they’ve been eager to make a splash in video conferencing.

ZM shares have endured one of the most painful crashes of the pandemic winners. At writing, the stock is just nearly 83% from its 2020 all-time high. Despite the severity of the meltdown, shares are still not at three-year lows.

Zoom Video stock is a prime example of why it’s dangerous to chase high-momentum stocks or get too euphoric on trends. While remote and hybrid work is likely here to stay, it’s clear that the valuation compression in ZM stock was needed.

Investors got way too euphoric with the name, and despite the magnitude of the decline, shares aren’t exactly a bargain at over 24 times trailing earnings. Therefore, I am neutral on ZM stock due to valuation and competition concerns.

Interestingly, Zoom has a 5 out of 10 Smart Score rating on TipRanks, also implying a “neutral” rating. This means that the stock is not very likely to outperform the overall market, according to this metric.

Zoom’s Video-Conferencing Rivals Could Get Stronger as Rates Rise

Now, Zoom may still be a best-in-breed platform for various remote, hybrid, and even on-site workforces. However, Zoom’s competitors are pretty scary and could pressure its margins over the coming years.

While Zoom has done a great job of expanding its lineup beyond just its flagship video service (think Zoom Phone and Zoom Rooms), I don’t view Zoom as having any products with a moat.

Indeed, wide moats are needed to stave off competition. As interest rates rise, the odds are likely to be tilted towards the disruptive tech behemoths (think the FAANG stocks) and away from smaller, albeit still large, firms like Zoom.

A company like Apple (AAPL) is rich with cash. With its massive share buybacks, the company has so much cash that it can do nearly anything it desires, including disrupting parallel markets. A firm like Zoom still has plenty to invest, but I think it’s safe to say that size is a larger advantage when credit isn’t so easy.

Which Rivals Should Zoom Keep Tabs On?

Zoom has a brilliant platform and many loyal enterprise users that it can upsell. However, it’s hard to tell just how “sticky” such users are, as companies like Apple, Microsoft (MSFT), and Alphabet (GOOGL) set their sights on taking share in the world of video conferencing.

Microsoft Teams is a top competitor of Zoom. Though Zoom has held its own well against the tech behemoth’s offering, Microsoft may have the edge when it comes to a shift into the metaverse.

Indeed, Microsoft Teams Mesh is a digital office environment that could be difficult to top. Further, Microsoft has deep pockets to invest in its popular Teams platform, which fits very well into its suite of office products.

With Apple’s Facetime and Alphabet’s Google Meet products also pushing to win over consumers and enterprises, Zoom’s market suddenly became incredibly crowded.

Google has pushed its Workplace offering pretty hard of late, and Apple is eager to capture business clients as well as bolster its services segment.

Google Meet seems to resemble Zoom’s flagship video-conferencing service in many ways. The service is included in the wildly-popular Gmail app, allowing Google to flex its network effect muscles.

Though Zoom has a wonderful product, rivals have recognized the opportunity to be had in the remote work trend, and they’re hungry to steal Zoom’s lunch.

While I do think Zoom and its rivals can co-exist, big-tech could become more disruptive if they can leverage their network effects through the inclusion of a video-conferencing service as a part of other apps. Indeed, Gmail is starting to look like a “super app,” with mail and video brought together.

How can Zoom keep its competitors at bay? It needs to continue to innovate to build its moat. To do that, it will need to continue spending to have the very best product on the market.

Wall Street’s Take on ZM Stock

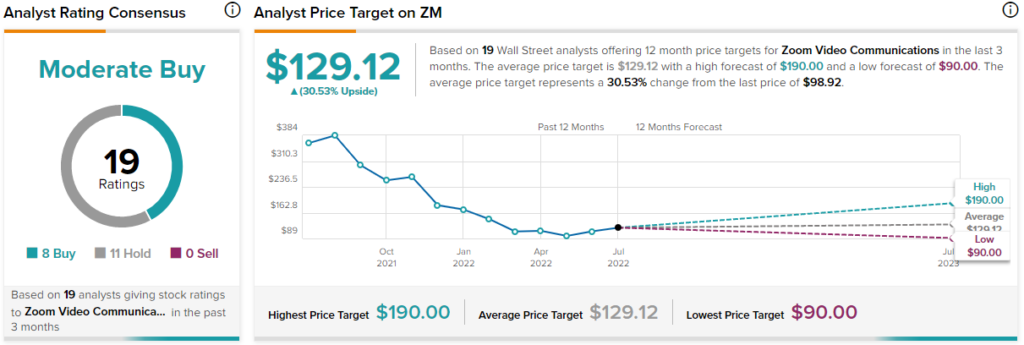

Turning to Wall Street, Zoom Video stock comes in as a Moderate Buy. Out of 19 analyst ratings, there are eight Buys and 11 Holds.

The average Zoom Video price target is $129.12, implying upside potential of 30.5%. Analyst price targets range from a low of $90.00 per share to a high of $190.00 per share.

The Takeaway: Valuation Leaves Little Margin of Safety

Zoom Video can thrive in the post-pandemic economy, but to do so, it needs to outpace some pretty stiff competition in the video-conferencing (and broader collaboration) market.

For now, Zoom has the tools to stay ahead. However, there is not much room for error. In any case, the valuation still seems too rich for my liking, given the risks associated with Zoom’s fast-moving FAANG rivals.

Google Meet and Microsoft Teams are two products that I’d keep tabs on as Zoom looks to differentiate itself and continue its growth.