So, what’s going on in the stock markets? Are they completely haywire? Since February 19, when the bull market ended, the Dow Jones has fallen 36.6% and then gained back, in uneven steps, some 26.4% from the trough. Movements have been similar in the S&P 500 and the NASDAQ. For the last two weeks, both the S&P and Dow have been holding fairly steady – the S&P near 2,800 and the Dow near 23,500.

Yet, there are more questions raised than answers. Are we in a true rally, or will the slide resume? What will happen when people return to work; will the economy pop back up again, or are we in a new recession? And if a recession, how bad will it get? The answer to that last may be worse than anticipated: the last five weeks have seen unemployment claims soar to 26 million.

Taking the bearish view, Mark Jolley of CCB International Securities believes that markets will start to fall again – and drop to some 15% below their previous lows for the year. Supporting his thesis that the current rally is a temporary ‘bear market rally,’ Jolley says, “…central banks can’t stop the weakness we’re seeing in growth, they can’t stop the severe earnings decline that we still are going to get and they can’t stop corporate bond defaults.”

If he’s right, then we are going to see a messy earnings season over the next few weeks. And since that will hit the markets hard, it’s time to consider defensive stocks, and how to protect your investment portfolio. The purpose of market investing is to make money: you buy low and sell high, realizing profits on the way. But that’s not the only route. Dividend stocks, which share company profits with stakeholders through regular dividend payments, provide a steady income stream for investors, no matter where the markets go.

Not all stocks pay out a dividend, but those that do can be lucrative. The average yield right now, among S&P listed dividend payers, is about 2%, about triple the return available from Treasury bonds. With a bit of diligence, aided by TipRanks database, it’s easy to find plenty of stocks with reliable dividend payments and far higher yields than average.

We picked 3 names that show impressive dividend yields above 8% and offer an upside potential of at least 15%. It’s a combination of factors that make them attractive as defensive portfolio moves in a bearish market.

Ares Capital Corporation (ARCC)

We’ll start with an asset management company, a niche that frequently pays out excellent dividends. Ares Capital is no exception to that generality – the company’s current dividend yield is impressive, over 14%. Ares supports its dividend with a wide-ranging portfolio of debt and equity investments in mid-market US companies.

Ares pays out 40 cents per share quarterly, or $1.60 annually. The payout ratio is high, at 88%, and shows a company commitment to returning profits to shareholders. Ares grew its dividend slowly over the past three years, usually by maintaining the regular payment and sending out special payments when possible. Q4 saw an additional 2 cents per share paid out that way. For Q1, the dividend has been declared at 40 cents.

Two months ago, Ares reported solid Q4 results, meeting the forecasts on earnings and revenue and supporting the special dividend payment. The top line grew 14% year-over-year, to $1.53 billion, while EPS came in at 45 cents per share. A possible cloud, especially in light of Q1 economic developments, was the 28% increase in overall expenses. Looking ahead, Ares sees Q1 EPS at 43 cents, more than enough to keep up the above dividend payments.

Writing from Compass Point, analyst Casey Alexander likes ARCC’s position in the business development world. He writes, “In an era where BDCs were pushing hard on incremental leverage and raising target leverage ranges simply to allow themselves to cover the current dividend, ARCC was patiently originating new deals, keeping leverage modest, and raising incremental equity capital in measured doses while still maintaining solid dividend coverage. We enthusiastically supported this strategy… ARCC is unquestionably a blue chip BDC, with a best in class management team.”

In line with this view, Alexander puts a $13 price target on ARCC, suggesting room for a 15% upside potential in the coming year. (To watch Alexander’s track record, click here)

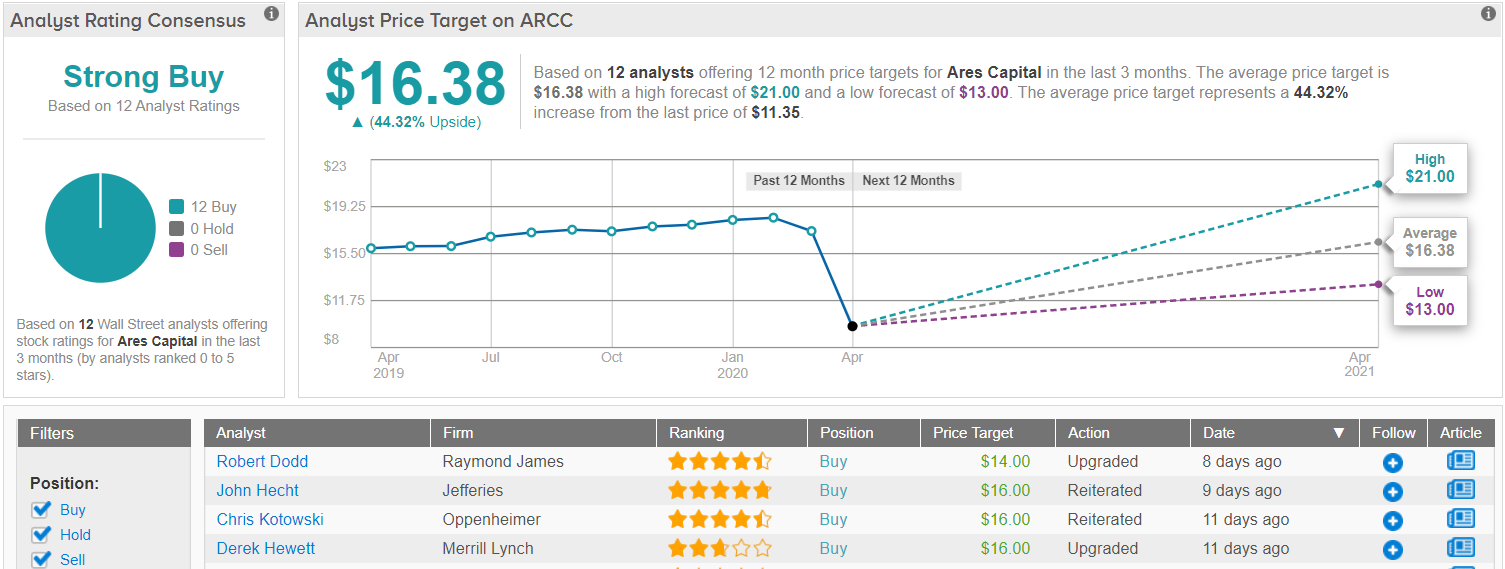

Alexander, while bullish on the stock, is somewhat conservative compared to the general Wall Street view here. Ares Capital has a Strong Buy analyst consensus rating, based on a unanimous 12 Buys set in recent weeks. The average price target is higher than Alexanders, at $16.38, and implies a stronger upside potential of 44% from the $11.35 share price. (See Ares Capital stock analysis on TipRanks)

MGM Growth Properties (MGP)

Next on our list is a real estate investment trust, a niche that frequently appears in any review of defensive dividend plays. REITs are required by tax law to return a high percentage of their profits to shareholders, and many use high-yield dividends as the vehicle of choice. MGM Growth Properties is typical of its niche in that regard. MGP focuses its own portfolio on large entertainment destinations – the company owns 13 properties in 8 states, mostly luxury casinos and hotels, with a combined total of 27,442 rooms. MGP’s operations brought in $881 million in revenue in 2019.

That revenue $275 million in net income, which was returned to shareholders through the 47.5 cent quarterly dividend. At $1.90, the annualized payment gives a yield of 8.1%, 4x the S&P average and a fine return in today’s climate of low interest rates. The company has been raising the dividend in small increments over the past four years, and the current payout ratio is 81.9%, indicating that the payment is safe at current income levels.

Deutsche Bank analyst Carlo Santarelli, in his review of the stock, maintained his Buy rating on MGP along with the $30 price target that implies a robust 29% upside potential. (To watch Santarelli’s track record, click here)

Supporting his bullish stance, Santarelli writes, “We continue to see considerable value in MGP at current levels and believe MGM’s considerable capacity to pay rent is underappreciated… We remain favorably inclined towards the gaming REIT subsector and believe MGP is well positioned from a liquidity perspective.”

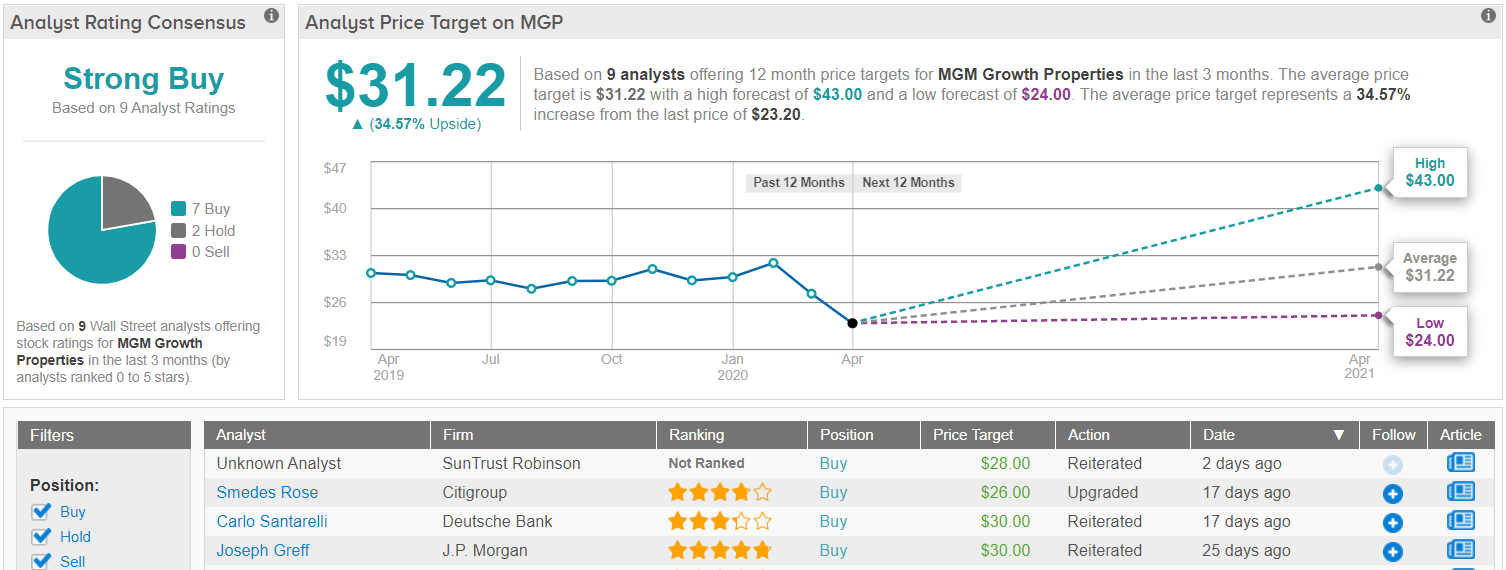

Overall, MGP has received 9 recent analyst reviews, breaking down as 7 Buys versus just 2 Holds and making the analyst consensus rating a Strong Buy. Santarelli’s forecast for the stock is a bit more cautious than his peers’ average; the stock has current trading price of $23.20 and an average price target of $31.22, indicating a 34% upside potential for the next 12 months. (See MGM Growth stock analysis on TipRanks)

Hercules Capital (HTGC)

Last on our list is a venture firm, a finance company that invests in start-ups, providing the funding, capital, and debt market access that small, early-stage companies so desperately need to but have such difficulty finding. Hercules focuses on the financial SaaS sector, life sciences, and technology, and to date has committed some $10 billion to its portfolio.

Hercules ended 2019 with a solid cash position, having $235.5 million in liquid assets available, a sum that included $64.4 million in unrestricted cash. The company uses its excellent cash position to fund a reliable, and steadily growing, dividend. The current payment is 32 cents quarterly, and the company felt confidence enough to issue a special 8-cent payment in Q4 to supplement the regular dividend. The annualized payment is $1.28, and gives a sky-high yield of 14.7%.

Aaron Deer, writing on Hercules for Piper Sandler, sees a sound future for the company, despite the COVID-19 epidemic: “We project solid loan production for the first quarter, but despite a big pipeline to start the year, that the outlook becomes hazier for subsequent periods. Increased caution among client companies may result in less loan demand or smaller deal sizes, though existing borrowers may look for larger lines, and competitive pressures from both equity and debt investors may wane some, allowing for better pricing on new deals… Hercules is well positioned with capital and liquidity to operate effectively through uncertain market conditions…”

Deer gives the stock a $10 price target, implying an upside of 15%, and supporting his Buy rating. (To watch Deer’s track record, click here)

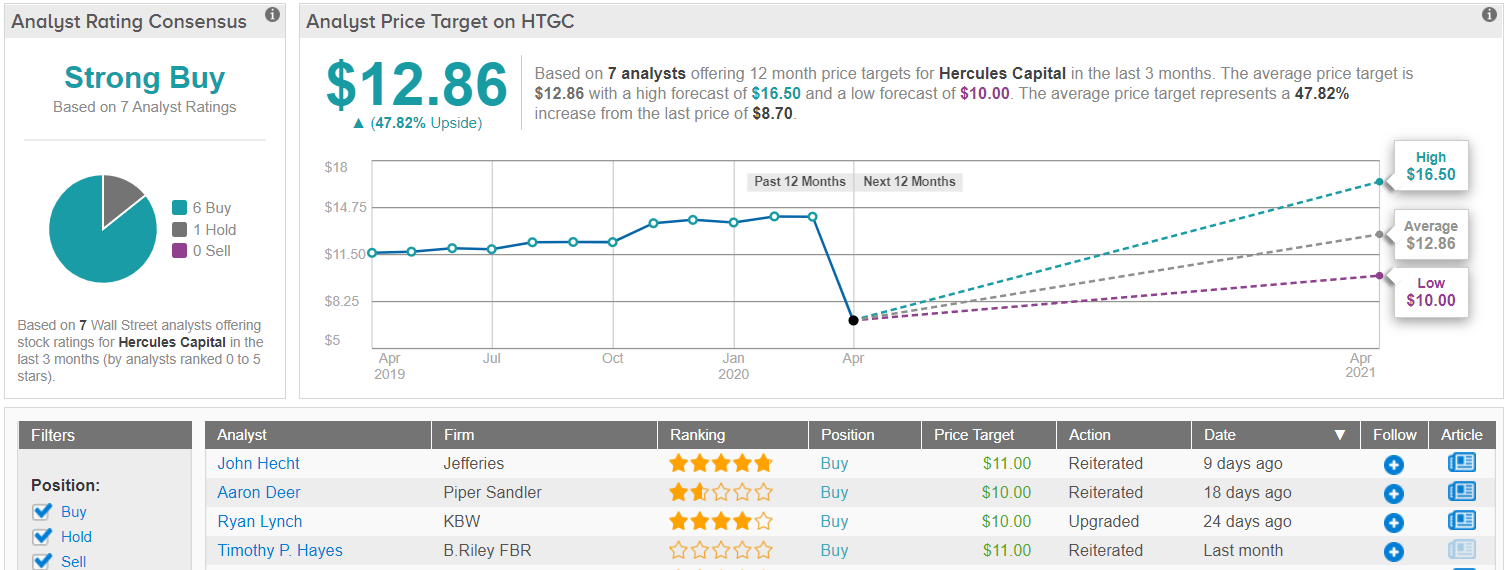

Wall Street is generally more bullish than Deer’s review above. The Strong Buy analyst consensus on Hercules is based on 6 to 1 Buy/Hold split among the reviews. Shares are selling for $8.70, and the average price target, at $12.86, suggests that there is room for 48% share appreciation over the next year. (See Hercules stock analysis on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.