Buy low, and sell high. That’s old wisdom, but it’s stayed with us through the ages because it’s a sure way to grow your money. In the stock market, of course, buying low is the easy part. There are plenty stocks out there priced at a discount – sometimes by the company’s design, sometimes by the vagaries of economic life. In either case, the real trick to investing is finding the discounted stocks that are primed for strong growth – those are the ones that will bring in profitable returns.

We’ve used TipRanks’ Stock Screener to sort through more than 6,300 publicly traded companies, and picked a profile for mid-cap stocks primed to gain: a high upside and Strong Buy consensus rating, but combined with recent losses that have left each of them trading well below peak price. Let’s dive in.

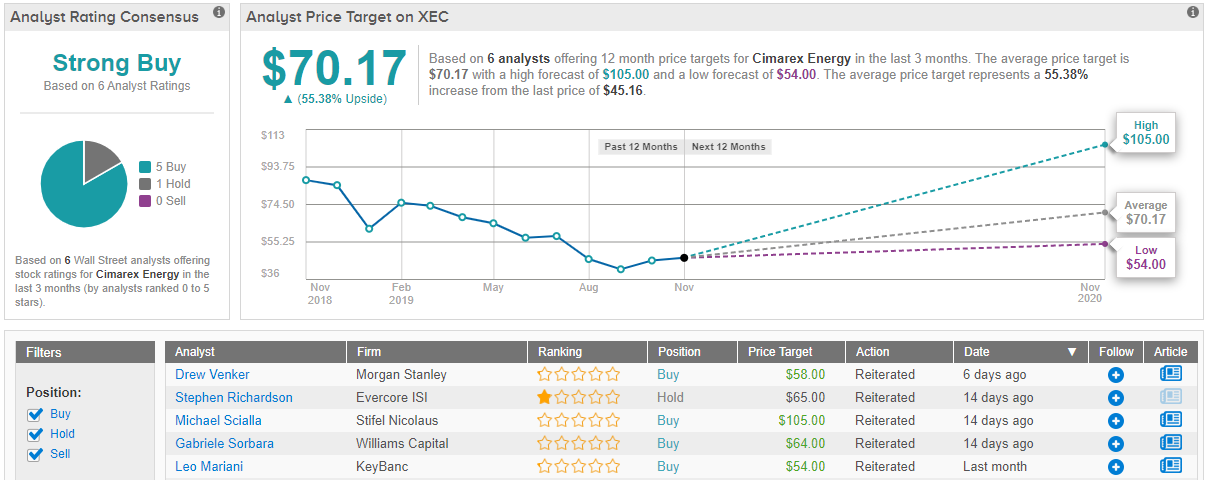

Cimarex Energy Company (XEC)

Starting in the energy sector, Cimarex is a hydrocarbon exploration company based out of Denver, Colorado. The company engages in oil and gas exploration and drilling in Oklahoma, Texas, and New Mexico. Cimarex controls over 591 million barrels oil equivalent, of which 45% is natural gas and the rest is split between natural gas liquid and petroleum. Last year, Cimarex average production stood at 222,000 barrels of oil equivalent per day.

Oil and gas bring in serious money, and even a small industry player like Cimarex sees nearly $2 billion in annual revenue and $490 million in net profits. In the Q3 earnings report released earlier this month, with EPS, at 91 cents, missing the forecasts, while the revenues of $582 million beating the estimates by 2%. Overall, XEC posted both EPS and revenue year-over-year declines.

The main driver of the decline was the current low-price regime in oil and gas markets. Production was actually up, and benefitting from increases in operational efficiency. XEC reported a 68.5 thousand barrel per day increase in total production, and a $3.34 per barrel of oil equivalent drop in production expenses. Prices, however, fell more and faster than production and efficiencies posts gains, with realized prices down 52% in natural gas and 10% in crude oil.

The drops in realized prices, EPS, and revenues this year have pushed XEC shares down by nearly 45% year-to-date. This opens buying opportunities, however, as far as Wall Street’s analysts are concerned.

Writing from UBS, Lloyd Byrne described the quarterly results as “solid,” based on the revenue beat and the efficiency gains, and expects to see it reflect in improved free cash flow next year. His $78 price target suggests an impressive 67% upside. (To watch Byrne’s track record, click here)

Jeanine Wai, of Barclays, also noted the efficiencies, and wrote of the company, “Once again XEC pulled forward activity during the quarter… Since we think efficiencies continue to trend well, we initially anticipated that XEC would again pull forward wells in Q4’19 providing an upward bias to production… We like the discipline and think that XEC’s anticipated 44 net wells waiting on completion at YE’19 provides good optionality for operational momentum heading into 2020 should commodity prices/costs ultimately allow for it.” Wai gives XEC an $81 price target and a 73% upside. (To watch Wai’s track record, click here)

All in all, TipRanks shows a large amount of bulls liking the odds on this oil stock. Out of 6 analysts polled in the last 3 months, 5 are bullish on Cimarex Energy stock, while only one playing it safe on the sidelines. Importantly, the 12-month average price target of $70.17 suggests a nearly 55% upside potential from where the stock is currently trading. (See Cimarex Energy stock analysis on TipRanks)

ANGI Homeservices (ANGI)

ANGI lives in the tech sector, inhabiting the information niche where it holds a portfolio of home improvement brands, and connects customers with the services they need. ANGI Homeservices is the world’s largest online marketplace for home improvement services, and connects homeowners with the service pros they need to get jobs done. The company operates in the US, Canada, and Europe.

The tech company’s earnings in Q3 are down year-over-year, from 9 cents to 4 cents, although still higher than the 3-cent estimate. Revenues, however, were up 17.8% to $357.36 million. It was the only time in the last four quarters that ANGI has beaten revenue estimates. In addition to falling revenues, ANGI has also deeply underperformed the broader market; with a 58% year-to-date loss compared to the S&P’s 24% gain.

However, top analysts see ANGI set up to start gaining as 2020 progresses.

Writing from Deutsche Bank, Kunal Madhukar says, “While the story remains in a “show me” mode, expectations have come down significantly in the past six months, which sets up well for a turnaround in 2020.” His $11 target implies about 50% upside to the stock. (To watch Madhukar’s track record, click here)

5-star analyst Daniel Salmon, of BMO Capital, is even more bullish, putting a $13 price target and 77% potential on ANGI shares. In his comments on the stock, Salmon concludes, “We think the “hybrid” approach of a third-party marketplace combined with a managed service marketplace is an improved strategy for a space as dynamic as home services.”

ANGI has received 6 ratings in the last two months for its Strong Buy consensus. The four most recent, all in the last two weeks, are Buys. The stock’s $12.25 average price target implies an upside of nearly 65% from the share price of $7.38. (See ANGI stock analysis on TipRanks)

Farfetch (FTCH)

This online clothing retailer, based in London, boasts offices in Portugal and Brazil, New York, LA, Tokyo, and Shanghai. The company has won industry awards for excellence in advertising and marketing, use of tech, and fashion design. With a market cap of $2.8 billion, FTCH is the smallest of the companies on this list.

Back in August, FTCH shares took a sudden drop, losing 52% of their value after the company spent $675 million to acquire New Guards. The purchase brought with it a new label for Farfetch to market, but the price was a significant portion of its total market cap.

Farfetch shares have still not recovered their pre-acquisition value. Last week’s Q3 report, however, helped, as the EPS loss of 28 cents was far less severe than the 37 cents expected. Revenues also scored a modest beat, coming in at $255.48 million compared to the forecast of $255.40 million. That was 89% year-over-year gain for revenues. The strong quarterly report boosted the stock by 29% on its release, although FTCH shares are still down 56% for 2019.

The gains, especially the high YoY revenue gain, suggest that FTCH maybe turning a corner on profitability. Deutsche Bank’s 5-star analyst Lloyd Walmsley agrees, writing in his recent note on the stock, “We like Farfetch shares over the longer term and see the New [Guards] acquisition as a good strategic fit, despite the increasing complexity of the model and slightly disappointing growth slowdown from 1H to 3Q… We feel comfortable the company can continue to grow at elevated growth rates and move closer towards profitability.” Walmsley’s $14 price target puts a 51% upside to the stock. (To watch Walmsley’s track record, click here)

Weighing in from Cowen, John Blackledge wrote just before the Q3 report was released, and he too saw potential from the New Guards deal. In addition, Blackledge specifically pointed out that FTCH’s low price point represents a purchase opportunity, as it takes into account the stock’s most likely deadweights: “With shares down ~57% since the 2Q print, we believe much of the downside risk around discounting and strategic direction are likely priced in.” Blackledge sees FTCH hitting $16 in the next twelve months, suggesting a powerful 72% upside potential.

FTCH shares base their Strong Buy consensus rating on 7 Buys and 1 Sell given in recent weeks. This stocks’ $15.29 average price target implies an upside of 65% from the $9.26 current share price. (See Farfetch stock analysis on TipRanks)