New month, same volatility. Kicking off the second quarter of 2020, all three of the major U.S. stock indexes dropped more than 4% yesterday in response to an update from the Trump administration. Late on March 31, the President stated the next two weeks will be “painful,” with health officials predicting a significant spike in COVID-19-related deaths.

As U.S. stock futures tick up on April 2, investors are worried the volatility is here to stay, and new economic data hasn’t calmed these fears. According to an ADP National Employment report, last month, private payrolls fell for the first time since 2017, by 27,000 jobs to be precise. It doesn’t help that new orders to factories reached its lowest point in 11 years.

In light of these developments, investment firm J.P. Morgan reassessed some of the names in its coverage universe. The well-known financial institution found that the impacts of COVID-19 have made several stocks riskier plays than they once were.

Bearing this in mind, we used TipRanks’ database to take a closer look at three stocks that have fallen out of favor with the firm. It turns out that the rest of the Street also takes a cautious approach when it comes to these tickers. Let’s take a closer look.

Plantronics Inc. (PLT)

Next up we have electronics company Plantronics, which provides business and personal headsets as well as audio solutions. So far in 2020, shares have plummeted 71%, and J.P. Morgan doesn’t see a recovery anywhere in sight.

After gaining more insight on PLT’s standing amid the ongoing public health crisis, analyst Paul Coster acknowledges that it’s positioned to endure the disruption caused by COVID-19. That being said, he argues that it would do so with limited balance sheet flexibility, and thus can’t recommend that investors do anything other than sell shares. “Consensus estimates through FY21 are too high, in our view, so downward revisions could weigh on the stock near-term. This downgrade is not a call to short the stock, but we are sidelined on elevated near-term risks,” Coster explained.

Speaking to these estimates, Coster expects voice, headset and product sales to fall by 25-30% year-over-year during the next two quarters, with the video and services segments taking a mid-single-digit hit. The gross margin prediction also gets a haircut, by 200 basis points to be exact. “We assume the firm bears down on operating expenses to moderate impact on cash flow… We expect sharp downward revisions to estimates to weigh on the stock near term,” the analyst said.

There is some good news, though. Following discussions with IT VAR/Distributors, observed enterprise and SMB behavior and the monitoring of Google search trends, Coster thinks the company might get a near-term boost from the increase in headset and some tele/conferencing equipment sales as more people start working from home.

However, the analyst noted, “… we think this is a temporary demand pull-forward, and we also believe it is probably offset by the decline in enterprise spending on on-premises desktop phones, conference phones, VTC equipment. We are also concerned that enterprises will sweat assets coming out of a downturn and that there will be a decline in service revenue associated with lower installation and usage levels.”

As a result, Coster gives PLT a thumbs down, downgrading his call from Neutral to Underweight. He also reduced the price target from $17 to $12, but the new figure still suggests 50% upside potential. (To watch Coster’s track record, click here)

The rest of the Street has reservations as well. 4 Holds and a single Sell issued in the last three months add up to a Hold analyst consensus. That being said, the $18.60 average price target puts the upside potential at 132%. (See Plantronics stock analysis on TipRanks)

Nio Inc. (NIO)

With the goal of being the first “User Enterprise,” Nio considers itself more than just a car company, offering high-performance, electric vehicles (EVs). Given that shares are down 36% in the last month and its engineering chief is set to depart amid ongoing reorganization, things aren’t looking good.

This is the stance taken by J.P. Morgan. Weighing in on Nio for the firm, analyst Ryan Brinkman states that while its Chinese name, Weilai, might translate to “blue sky is coming”, this isn’t the case for the company. Against the current tumultuous economic backdrop, the industry as a whole is facing headwinds like weak consumer sentiment and the growing localized entry of foreign brands into the EV space. “Fundamentally, we have two key reservations: 1) slow sales and a challenging NEV market; and 2) funding and financing,” the analyst commented.

Based on Brinkman’s estimates, PV demand in China is slated to take another 7% hit in 2020 as a result of poor consumer sentiment and a weak economy. In addition, the challenging nature of the auto market as well as steep competition from Tesla and other EV start-ups in China do little to improve Nio’s prospects.

In order to stimulate demand in China, the government will potentially cut the NEV subsidy in the second half of 2020, but this works against Nio. “Further, the government’s efforts to boost auto demand by easing purchase restrictions for NEVs could increase competition for NIO,” Brinkman explained.

It should also be noted that Nio recently reached an agreement with Hefei Government for additional funding after a $200 million convertible note and two $100 million convertible bonds were issued. When the company receives the funding support, Brinkman thinks that Nio will be stable in the near-term with respect to cash. However, the five-star analyst argued, “While the funding size and deal structure have not yet been decided upon or disclosed, we do not rule out the possibility of NIO needing further funding in 2H20/2021, considering the pace of cash burn. Possible equity dilution is another factor investors need to consider.”

To this end, Brinkman assumed coverage of this stock with an Underweight rating and $2 price target. Should shares reach this level in the next year, Nio stands to see 25% of its value erased. (To watch Brinkman’s track record, click here)

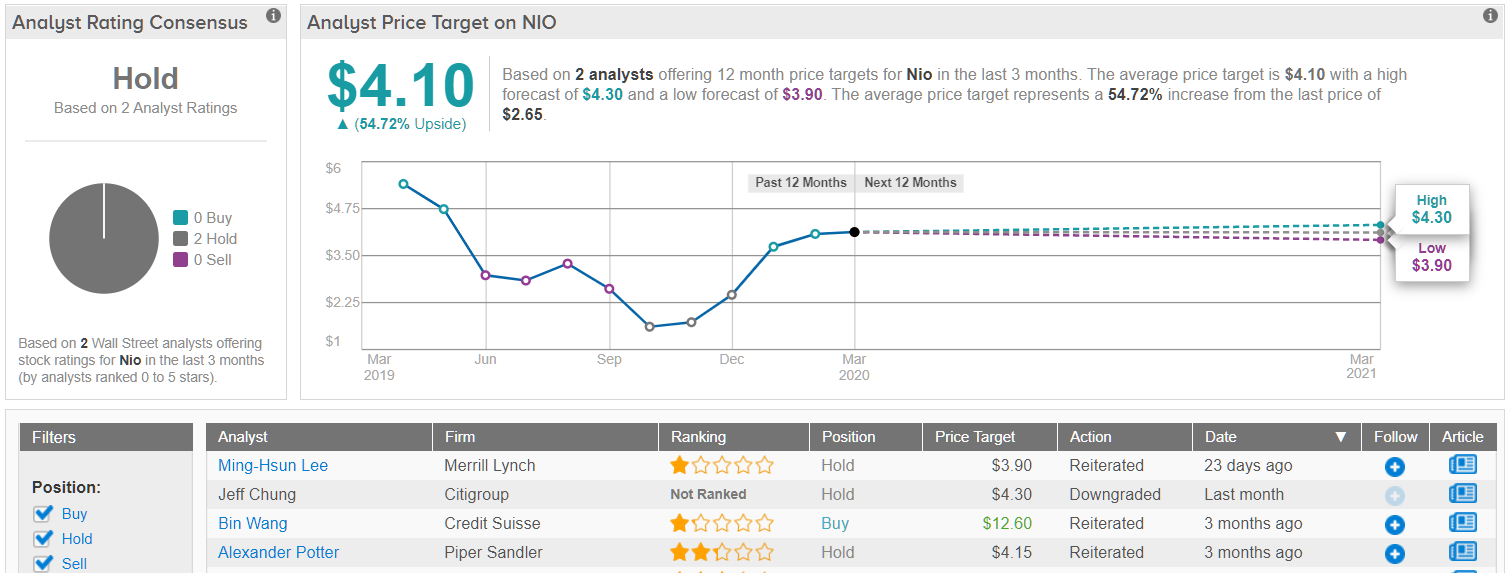

Turning now to the rest of the Street, other analysts are staying on the sidelines. With 2 Holds published in the last three months, NIO earns a Hold consensus rating. However, at $4.10, the average price target implies 55% upside potential. (See Nio stock analysis on TipRanks)

Diebold Nixdorf Incorporated (DBD)

Like Plantronics, banking solutions and retail technology systems provider Diebold Nixdorf has shed 71% of its value year-to-date. Add in a recent downgrade from J.P. Morgan, and it’s clear why this name has received negative attention from investors.

Writing for the firm, Paul Coster, who also covers Plantronics, isn’t necessarily recommending that investors short the stock. Rather, DBD’s exposure to end-markets heavily impacted by COVID-19 makes the stock just too risky.

Explaining this assumption, the analyst stated, “Neither DBD nor Neutral-rated NCR stocks seem appealing at present, despite trough-level forward multiples, but we prefer NCR in view of the cash on hand following last night’s revolver drawdown.”

Based on the mounting evidence that “COVID-19 is dramatically reducing foot-traffic in retail, hospitality and bank branches, and that field service resources cannot be deployed to deployments”, Coster believes the bottom line will take a beating. “We look for DBD to generate 2020 PF EPS of $0.33 on revenue of $4.1 billion versus consensus of $0.99 EPS on revenue of $4.2 billion, and we believe risks are skewed to the downside,” he noted.

Having said that, should both revenue and earnings level out and improve in the second half of 2020, liquidity most likely won’t be at risk. However, as Coster doesn’t see DBD’s leverage ratio getting better throughout the year, and the DN Now program might need to be ramped up thanks to swings in working capital, the long-term growth narrative appears weak.

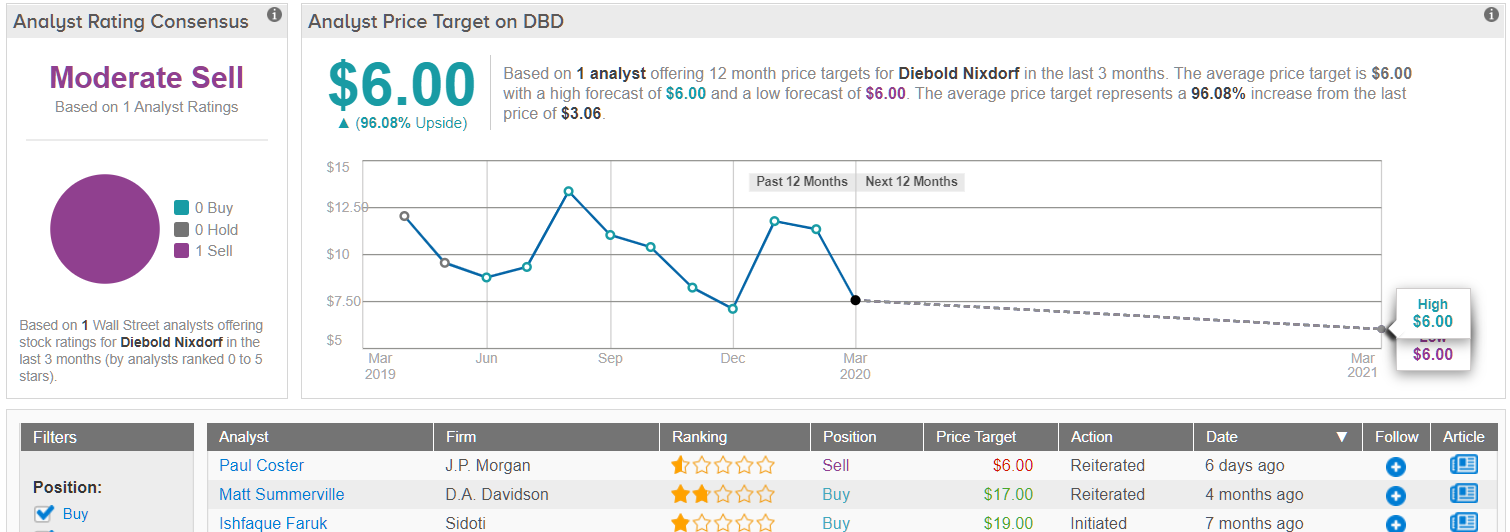

In line with this conclusion, Coster downgraded the stock from Neutral to Underweight and cut the price target by $2. Still, this new $6 target conveys his belief that shares could soar 96% in the next twelve months.

Looking at the consensus breakdown, it has been quiet when it comes to other analyst activity. Coster’s downgrade is the only recent review, making the consensus rating a Moderate Sell. (See Diebold Nixdorf stock analysis on TipRanks)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.