Qualcomm (QCOM), the world’s largest mobile chipmaker, hasn’t had an easy ride in 2020. Of course, you can say that about an ever-growing number of companies, but the semiconductor giant’s large exposure to China and accompanied uncertainty concerning Apple’s 5G enabled phone launch, has seen it underperform its peer group.

But according to Tigress Financial’s Ivan Feinseth, there’s no need to ring the alarm bells. In fact, the 5-star analyst argues, there are numerous short- and long-term drivers for Qualcomm, that its “leadership position in the global high-speed 5G network rollout will overcome any near-term COVID-19 pandemic-related weakness.” Accordingly, the 5-star analyst reiterated a Buy on QCOM shares. (To watch Feinseth’s track record, click here)

Feinseth believes that, in addition to the central role QCOM will inevitably play in the rollout of 5G networks, its technologies are set to influence a host of industries – from energy to healthcare, to gaming and logistics. What’s more, the company’s forays into AI applications and high-speed edge computing will further boost an already strong balance sheet.

While Qualcomm is best known for supporting mobile phones, its portfolio of automotive products, which include semiconductors for the telematics systems in cars, is constantly expanding. The latest addition was announced earlier in the year with the unveiling of Snapdragon Ride, which according to Feinseth is “one of the auto industries’ most advanced, scalable, and open autonomous driving solution development platforms.”

Additionally, the launch of several new processors, including its QCA6390 connectivity SoC (System-on-a-Chip) processor, are “redefining the computing and mobile ecosystem it originally pioneered.”

With Wi-Fi 6 set to become the accepted standard for wireless comms, Qualcomm believe the QCA6390 will support up to 1.8 Gbps, and claim that, to date, it is the fastest throughput of any comparable smartphone chipset.

Sealing the deal for Feinseth, is QCOM’s financial health. The analyst concluded, “As of December 2019, QCOM had $10.20 billion, $8.91 per share, in excess cash, and we expect it will generate $16.57 billion in Economic Operating Cash Flow (EBITDAR) over the NTM… QCOM’s strong balance sheet and cash flow continue to drive investments in innovation and key growth initiatives, help provide stability in a volatile market, and enhance shareholder returns through periodic dividend increases and share repurchases.”

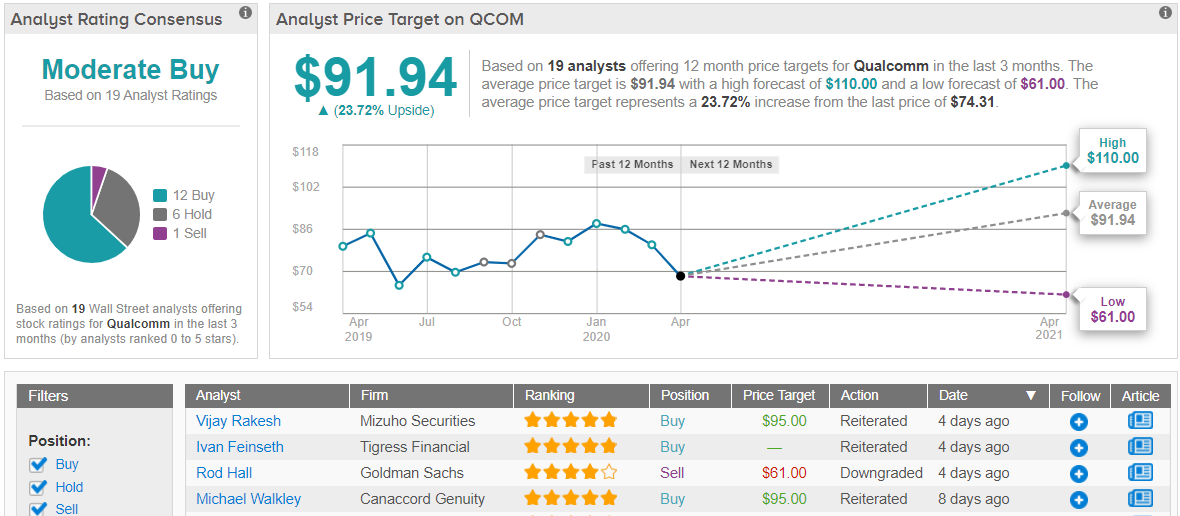

So, that’s Tigress Financial’s view, now what about the rest of the Street’s take? 12 Buys, 6 Holds and 1 Sell coalesce into a Moderate Buy consensus rating. With an average price target of $91.94, the analysts foresee upside in the shape of nearly 24% over the next year. (See Qualcomm stock analysis on TipRanks)

To find good ideas for tech stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.