Xilinx reported better-than-expected 2Q results and provided an upbeat sales outlook for 3Q, helped by the chipmaker’s data center and aerospace & defense businesses. Shares gained 2% in the extended trading session on Wednesday.

Xilinx’s (XLNX) 2Q adjusted EPS of $0.82 beat Street estimates of $0.77. The company’s quarterly revenue of $767 million also came higher than the Wall Street forecast of $756.7 million and was above the mid-point of its guidance range of $730-$780 million. Still, the top and bottom lines fell 8% and 13%, respectively, on a year-over-year basis.

“We are pleased with our fiscal second quarter performance, which came in above the mid-point of guidance,” said Xilinx CEO Victor Peng. “Our strong results were driven by another record quarter in our Data Center Group and Aerospace & Defense businesses, as well as improvement in our Automotive and Broadcast end markets.” (See XLNX stock analysis on TipRanks).

Buoyed by stronger-than-expected 2Q results, Xilinx provided strong revenue guidance for 3Q. The company expects sales to be between $750 million and $800 million in 3Q, which at the mid-point is above the Street estimates of $772.3 million.

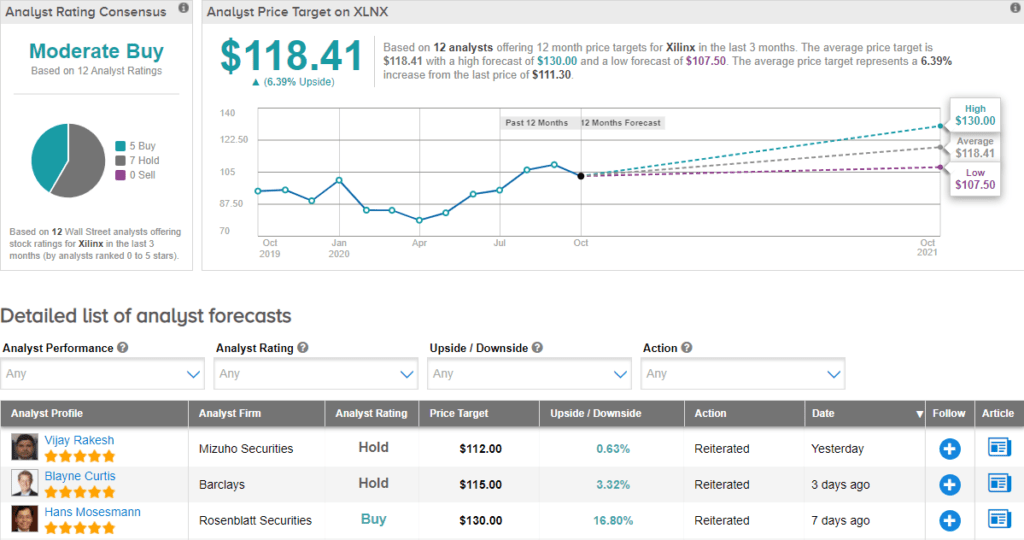

Following Xilinx’s 2Q results, Mizuho Securities analyst Vijay Rakesh raised the stock’s price target to $112 (0.6% upside potential) from $110. However, Rakesh reiterated his Hold rating saying that “XLNX faces near-term 5G (fifth-generation wireless) FPGA (Field Programmable Gate Arrays) challenges.”

Currently, the Street is cautiously optimistic on the stock. The Moderate Buy analyst consensus is based on 5 Buys and 7 Holds. With shares up nearly 14% year-to-date, the average price target of $118.41 implies further upside potential of about 6.4% to current levels.

Related News:

Telia Inks 5G Network Deals With Ericsson, Nokia

KeyCorp’s Profit Rises As Credit Loss Provisions Drop 20%

Prologis’ 2020 Outlook Tops Estimates; Street Says Buy