The investment adage that the market hates uncertainty is oft cited and arguably playing out since the coronavirus and a coordinated national effort to stem the spread by keeping as many people quarantined at home as possible. In many respects, earnings and dividend visibility are near historic lows.

It’s fortunate then that the stock market is holding up well in the midst of this record uncertainty. The million dollar question is just when business gets back to normal. There are certainly fears that a second wave will spread throughout the U.S. come this fall, but according to one estimate, that too shall pass and the stock market could hit another record high (the last one was just in February) in the first half of 2021.

JPMorgan strategist Marko Kolanovic believes that the quick and aggressive actions taken by the Federal Reserve should end up offsetting the hit our economy takes while staying focused on beating the coronavirus back to the bat cave where it is reported to have originated. The combined effect of lowering interest rates and investing heavily in fixed income markets to keep credit spreads from widening could prove to be a big boon to the stock market.

Kolanovic estimates that the discount rate, which is key input to stock valuation models, is down to 1.25%. The implication is higher stock market values (a lower discount rate increases the present value of future company earnings) and more than enough to offset the “negative impact of the temporary earnings loss.” The fact Kolanovic sees the reduced profitability as temporary is another positive sign and key reason he sees the market regaining February highs at some point at some point in mid-2021.

With this in mind, we looked at some of JPMorgan’s stock recommendations, which we cross checked with data and analysis from the TipRanks databases. We uncovered a couple of high-yield stocks to consider for your portfolio, but one that is looking like a much less safer bet in the current environment.

TCP Pipelines (TCP)

Houston, TX based TC Pipelines, LP, or TCP, owns and manages energy infrastructure businesses in North America. TCP has invested in eight natural gas interstate pipeline systems that transport approximately 10.9 billion cubic feet per day of natural gas. In a recent investor presentation, TCP touted its financial discipline, including a healthy balance sheet where its dividend is covered, it self-funds its growth and maintenance of its pipelines, and boasted it does not need to access the capital markets in the near future.

TCP’s current dividend yield is 8%. Its annual payout is $2.60 and is projected to stay at this level for this year and next. It also happens to be the payout over the past two years. According to JPMorgan, the payout looks to also be steady and is attributed to a “utility-like” payout where 90% of the cash flows are already under contract.

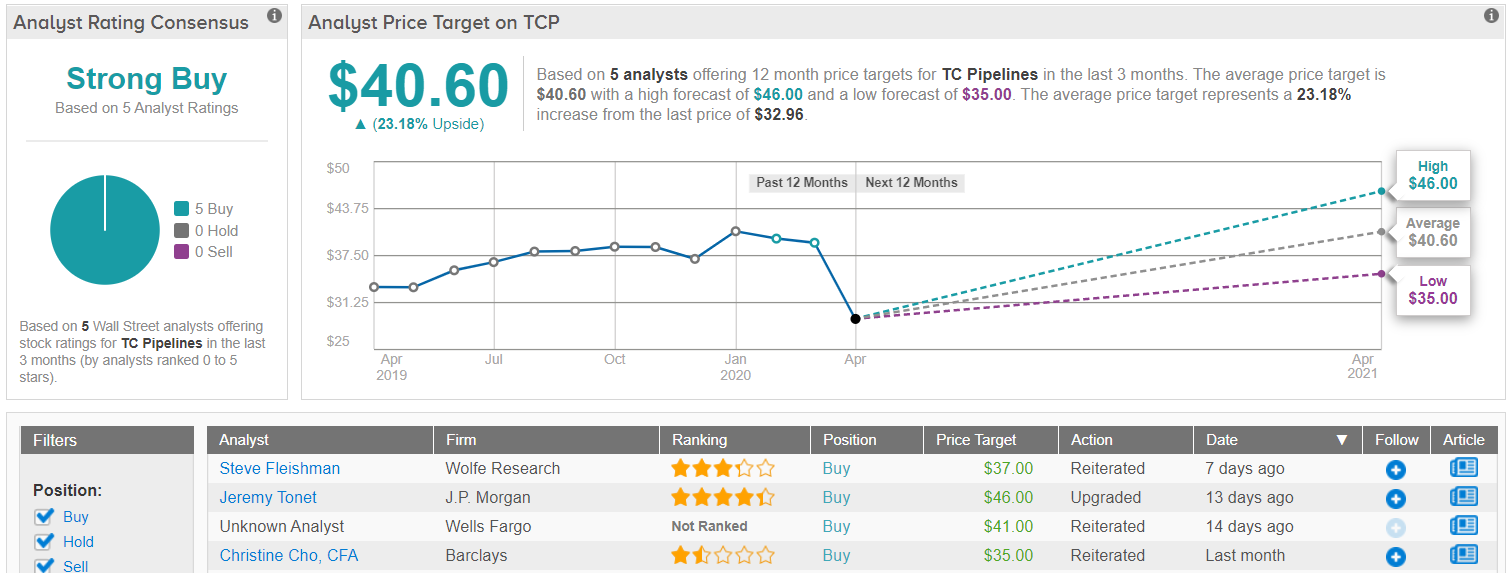

TCP’s steady business trends have not gone unnoticed. JPMorgan analyst Jeremy Tonet recently upgraded TCP to Overweight along with a price target of $46. This represents upside of 40% from the current share price of $32.96. (To watch Tonet’s track record, click here)

Tonet detailed in the report a belief that “TCP stands well positioned to weather a lower for longer environment, with materially less fundamental downside risk.” He also added “we believe possessing stable, predictable cash flows backed by take-or pay/regulated cash flows with strong counterparties remains paramount in this environment.”

The analyst’s bullishness gets the backing of his colleagues, as TCP has a Strong Buy rating from the Street. The 5 “buys” ratings provide an average price target of $40.60, implying upside of 23% from the current price of $32.96. Stock gains and a steady payout are a great combination. (See TCP stock analysis on TipRanks)

Interpublic Group of Companies (IPG)

New York City-based Interpublic Group, IPG is a preeminent advertising and marketing firm. Services include what you might imagine: advertising, digital marketing, communications planning and public relations. Its market capitalization is $6.1 billion and it is one of the largest advertising firms in the world.

When times are tough, many firms cut back on advertising. This a key reason that IPG’s stock is down 30% so far this year to a recent $15.73. However, this has pushed its dividend yield up to 6.9%.

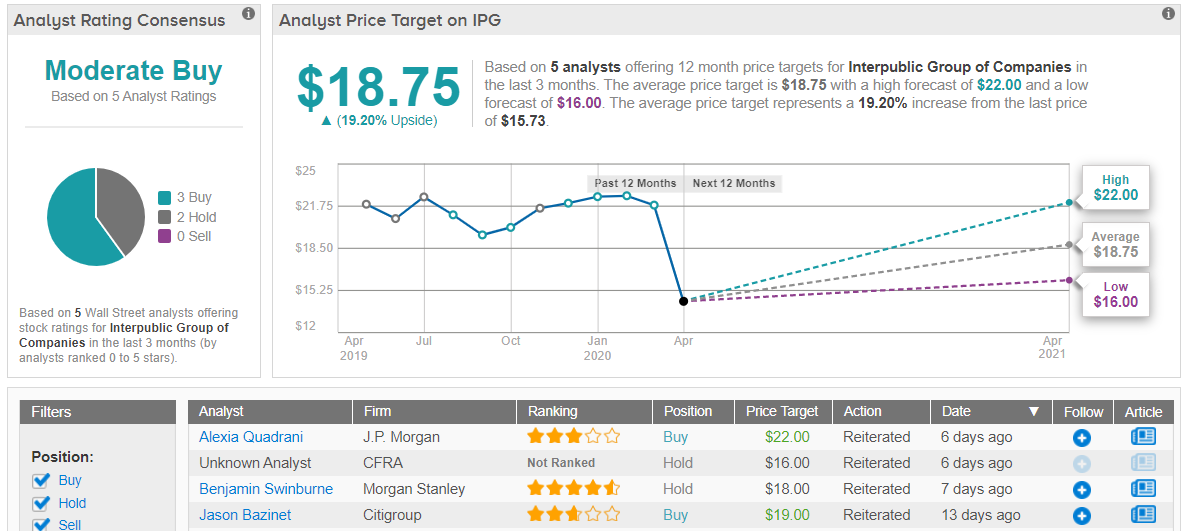

JPMorgan analyst Alexia Quadrani recently reiterated her Overweight rating on IPG shares, and sees the dividend as safe because of a strong balance sheet and solid cash flow generation that covered the payout by a wide margin last year. The bullish rating comes with a $22 price target, suggesting a hearty 40% upside from current levels. (To watch Quadrani’s track record, click here)

Quadrani concedes that earnings visibility has declined on the back of covid-19 uncertainty, but points out that 28% of IPGs business stems from healthcare clients. Healthcare is seen as highly recession resistant and is obviously at the forefront of helping the U.S. contain and control the coronavirus. Technology and telecom services have also benefited from the pandemic as workers stay hunkered at home to work. This is another 17% of IPG’s business which, when combined with even steadier healthcare, is nearly half its sales.

Overall, Quadrani believes IPG will hold up better than its peer group. The analyst postulates that lead clients will turn to advertisers to communicate how they are adjusting to covid-19 and focusing on safely selling their products while protecting customers and employees. To this end, Quadrani projects EPS of $1.49 for 2020 and $1.80 in 2021.

According to the TipRanks database, 5 analysts cover IPG. The consensus isn’t all bullish; 3 have buy ratings and 2 recommend holding the stock. The average price target among this group is $18.75, which would be a still healthy 19% boost from the current share price. (See IPG stock analysis on TipRanks)

Weingarten Realty Investors (WRI)

Weingarten Realty Investors owns, manages, and develops shopping malls. It recently boasted 170 properties in 16 states for a total square footage of 32.5 million square feet. Weingarten focuses on neighborhood and community shopping locales and boasts a fair amount of grocers and other related necessity-based tenants. However, Weingarten is a small player in the national mall space. Its market capitalization is $2 billion and has fallen 37% this year alone. That has pushed the dividend yield to a reported 10.7%.

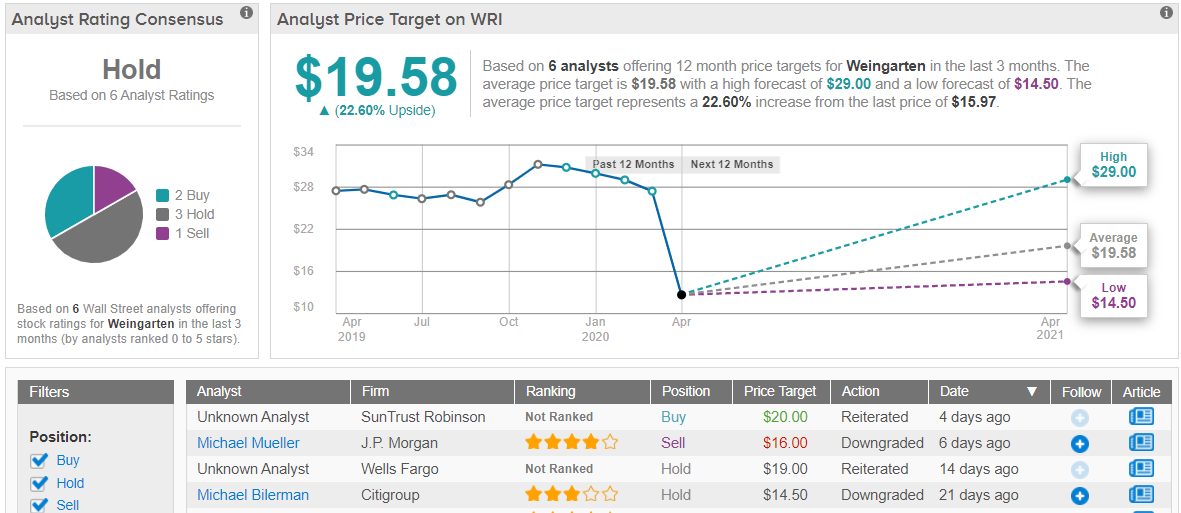

JPMorgan is particularly worried about Weingarten’s small size. In lead analyst Michael Mueller’s opinion, “we tend to view WRI as having a meaningful small shop exposure, which is typically where headwinds can emerge (particularly as it relates to locals).”

Mueller estimates lower earnings estimates, lower long term growth, and a higher discount rate because of the higher risk to its operating model. This is a key reason Mueller has significantly lowered the firm’s year end 2020 price target to $16/share (previously $29), while downgrading the stock from Neutral to Underweight.

The TipRanks database caught Mueller’s Sell rating. The other 5 analysts are a little more bullish, but not by much. 2 have Buy ratings and 3 recommend you hold on. The average price target is $19.58 and would represent a 23% increase from current levels. (See Weingarten stock analysis on TipRanks)

To find good ideas for dividend stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.