Nvidia Corporation (NVDA) is interested in buying SoftBank Group’s chip designing company, Arm Ltd. Citing people familiar with the matter, Bloomberg reported on Wednesday that Nvidia has approached the Japanese investment group in recent weeks about a deal for Arm.

Bloomberg stated that “A deal for Arm could become the biggest-ever acquisition in the chip industry.” The UK-based chip designing company was bought by SoftBank in 2016 for about $32 billion.

According to Bloomberg, SoftBank had been exploring options including a full or partial sale of the UK-based chip designing company. Reportedly, the investment group had approached Apple (AAPL) to gauge its interest but the latter shows no intention in pursuing a bid.

Arm’s chip designing and licensing operations would be a perfect fit for Nvidia. The acquisition would help the graphic chip maker enhance its chip designing capabilities and strengthen competitive position against Advanced Micro Devices (AMD) and Intel (INTC).

On July 7, Bank of America analyst Vivek Arya raised the target price on Nvidia to $460 from $420. The analyst stated that strong trends surrounding the gaming industry could boost Nvidia’s gaming sales in the second half of 2020.

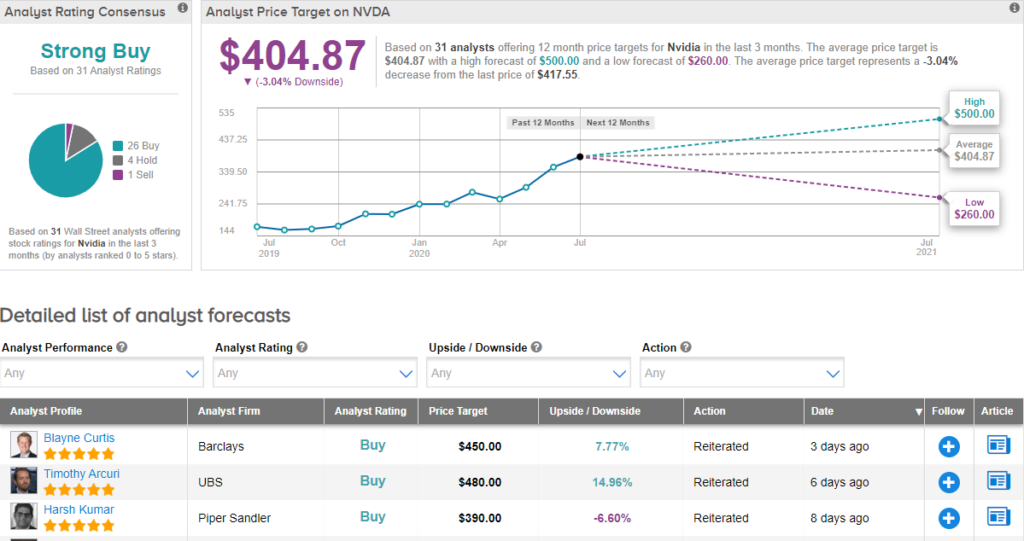

NVDA stock has surged nearly 78% year-to-date, and analysts have an optimistic Strong Buy stock consensus. However, the average analyst price target of $404.87 implies a potential decline of 3% from current levels. (See Nvidia’s stock analysis on TipRanks).

Related News:

Microsoft Plans To Become Carbon Neutral By 2030

Facebook Forms Teams To Search For AI-Programmed Racial Biases

5G Tailwinds to Drive Micron Growth, Says 5-Star Analyst