GoPro Inc (NASDAQ:GPRO) shares had several ups and downs this year. However, these top 5 ratings on the company were timed correctly and earned a significant profit.

1. The most profitable rating of 2015 for GoPro was made by Gus Richard of Northland Securities on March 2, 2015 when the analyst reiterated an Outperform rating for the company with a $70 price target. Richard made the rating after the company’s shares dropped due to Xiami, a Chinese smartphone company, launching the Yi Action Camera, a product similar to GoPro. Responding to investor concerns regarding the product affecting the company’s Chinese sales, the analyst believed that this launch “[validated] GoPro’s business model” and assured that “the company’s opportunity [was] significantly larger” than that of its then new competitor. The analyst stated that the company’s estimates were “conservative,” and believed that GoPro’s higher-end products outweighed the Yi Action Camera features, which were slightly better than the company’s entry level Hero product.

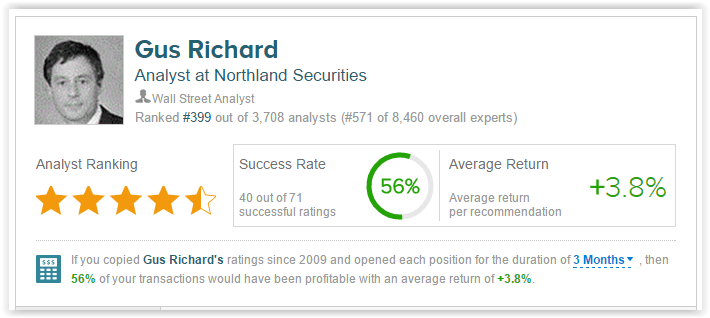

At the time of Richard’s rating, shares of GoPro were trading at about $40. Three months later, shares rose to $58.50. If you had purchased shares of GoPro when Richard suggested, you would have made a 46.50% return. Overall, analyst Gus Richard has a 56% success rate recommending stocks with an average return of 3.8% when measured over three months.

2. Michael Pachter of Wedbush made the second most profitable GoPro rating of 2015 on April 24, 2015, when he maintained his Outperform rating on the company with a $70 price target in anticipation of its Q1/2015 earnings. Pachter expected GoPro to post revenues in line with consensus and EPS slightly below consensus. He expressed bullish sentiment regarding demand, competition, international growth, and guidance. He stated, “Demand for GoPro products appeared brisk throughout Q1, with the sales ramp in China helping. We do not expect competition to have a material impact on GoPro sales near-term, as alternative products don’t match the value proposition of the entry-level HERO, nor the feature set of the high-end HERO4 products. More importantly, competing products don’t match GoPro’s consumer appeal.” He continued, “We expect guidance of $350 million or above, as an increasing presence internationally more than offsets any F/X drag.”

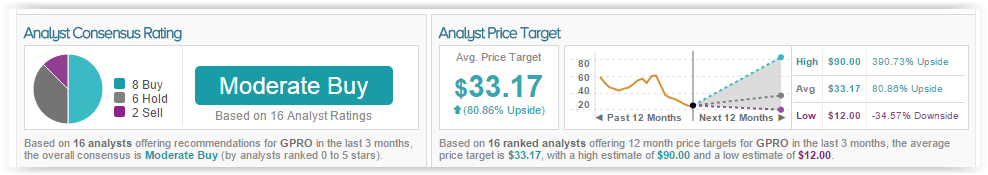

At the time of Pachter’s rating, GoPro shares were trading at about $45. After three months, shares increased to about $62. If you had followed Pachter’s advice, you would have made a 38.9% profit in three months. According to TipRanks’ statistics, out of the 16 analysts who have rated GPRO in the last 3 months, 8 gave a Buy rating, 2 gave a Sell rating, and 6 remain on the sidelines. The average 12-month price target for the stock is $33,17, marking an 81% upside from where shares last closed.

3. The third most profitable GoPro rating of 2015 was made by JMP Securities analyst Alex Gauna on March 4, 2015, when the analyst reiterated his Market Outperform rating with a $105 price target. The rating came after Ambarella, GoPro’s main supplier, reported earnings earlier that week. As a result of Ambarella’s earnings, the analyst predicted 48% growth for the company’s March quarter and 43% growth for the company’s June quarter, including 30% revenue growth and higher gross margins. In addition, Gauna increased his FY15 non-GAAP EPS estimate for the company. Other reasons for his bullish rating included the Hero4+ upgrade cycle, the introduction of a cloud platform, and increased new media opportunities.

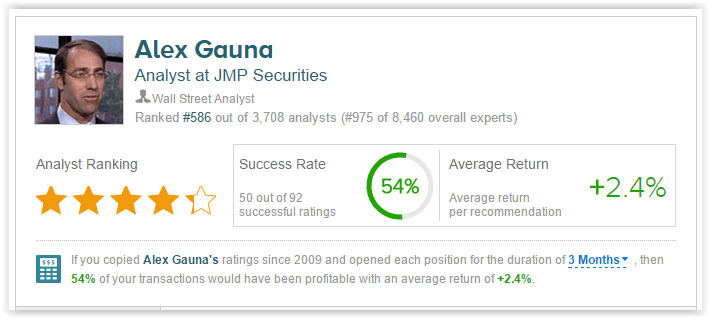

On March 4, 2015, GoPro was trading at about $43. Three months later, shares rose to about $59. If you had purchased shares of GoPro when Gauna suggested, you would have made a 36.8% return in 3 months. Overall, analyst Alex Gauna has a 54% success rate recommending stocks with an average return of 2.4% when measured over three months.

4. The fourth most profitable GoPro rating of 2015 was made by Charlie Anderson of Dougherty and Co. on April 27, 2015 when the analyst reiterated a Buy rating on the stock with a price target of $55 in anticipation of its Q2 earnings release. The analyst stated, “We believe GoPro has established itself as one of the most valuable brands in consumer technology and has significant headroom to grow as it expands overseas and extends the brand to new device categories.” He was further bullish about the company’s new product categories, stating the potential for further sales increases. He also believed the company would release a new camera and aerial drone.

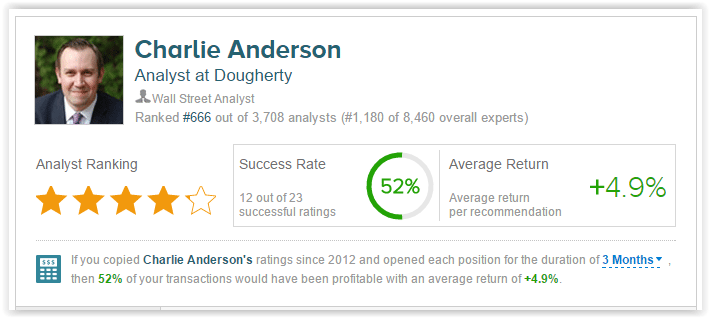

At the time of Anderson’s rating, GoPro’s stock was valued at about $45. Three months later, the stock rose to about $61. If you had followed Anderson’s advice to purchase shares GoPro at the time of his suggestion, you would have made a 35.5% profit in three months.

5. Erinn Murphy of Piper Jaffray made the fifth most successful GoPro rating of 2015 on April 20, 2015 when she maintained her Overweight rating on the company with a price target of $55. The analyst attributed her bullishness to GPRO’s growth and market share potential, believing the stock was undervalued at the time. She also stated that the company had the potential to double its unit sales over time. She commented, “From a thesis perspective, this is a relevant consumer brand benefiting from early stage of customer adoption through accelerating product sales of capture devices within a broader eco-system that is capitalizing on experiences.” The analyst continued, “We believe sales and margins can best Street estimates for Q1… Relative to consensus, our 2H estimates are higher driven by: 1) stronger than expected upgrade cycle success; 2) distribution expansion and continued sell through momentum in Europe & Asia and 3) ongoing strength of the $130 HERO as the consumer market for action cameras broadens.”

At the time of Murphy’s rating, GoPro’s shares were trading at about $45. Three months later, shares rose to $60.80. If you had purchased shares of GoPro when Murphy suggested, you would have earned 35.4% return in three months.